#Snowflake #SNOW #CloudData #AIStocks #RHYTHMIXReport

#BreakoutAnalysis #MomentumStocks #TechStocks #EarningsSurprise

Hello, this is Top Trader Jinlog.

You can view this analysis with full charts on the blog.

For ongoing reports, feel free to subscribe or drop a comment.

If you want faster insights, choose the Priority Review option.

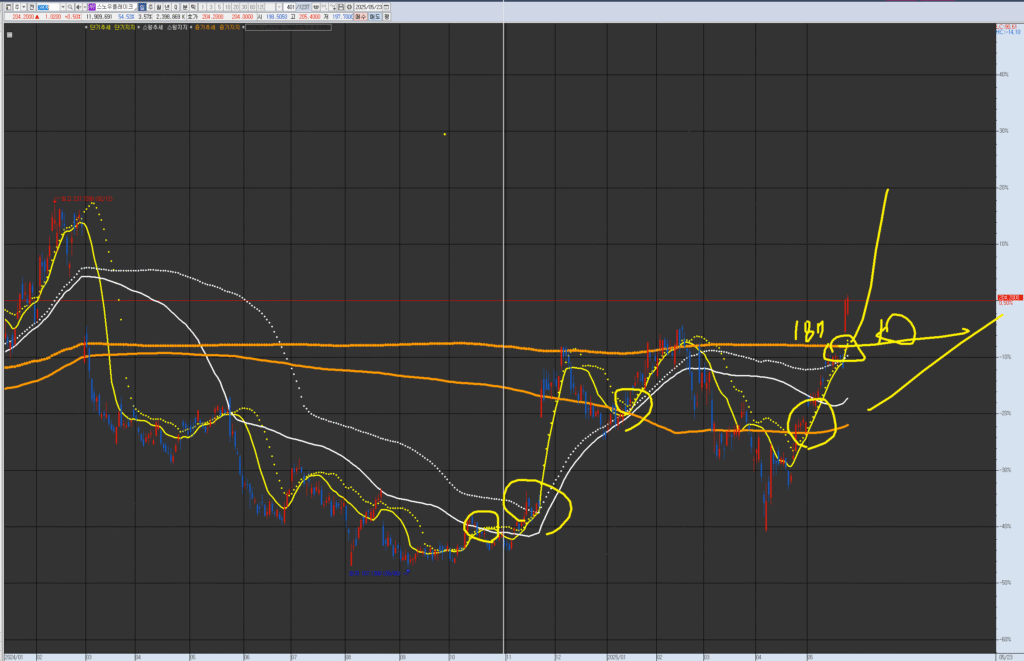

VPAR Chart Explanation This is Snowflake (SNOW.NYS), as requested for analysis. The circled areas in the past and present are potential short-term trend turning points; consolidation coupled with an upward trend represents a trading entry point. Each chart has its own wave pattern/trend. Currently, it is showing demand within the short-term trend and has broken through the medium-term resistance/supply level. Consider trading based on the short-term (daily wave) trend, and if it breaks below, consider it a potential buying point starting from around 186.

💡 Investment Opinion

Snowflake has surprised the market with strong Q1 performance and a raised full-year outlook.

This latest surge over $200 signals a technical rhythm breakout and a fundamental validation of its renewed AI-driven cloud strategy.

2-week expected return: +6.5% → $217.50 (Probability: 68%)

2-month expected return: +15.2% → $235.00 (Probability: 61%)

2-year potential target: +37.9% → $281.00 (Probability: 48%) → Fibonacci extension (1.618 level)

1. 📌 Summary

Following a better-than-expected earnings report, Snowflake’s price surged ~10% and re-entered the $200+ psychological zone.

This is the first time in 15 months that the stock is showing a clear rhythm reacceleration pattern.

MACD, volume, and Bollinger band widening all support this being more than just a post-earnings spike.

2. 📈 RHYTHMIX Rhythm Analysis

🔹 Monthly Rhythm

- Mid-term bottoming structure is completed

- First full-bodied bullish candle reclaiming Bollinger midband

- Rhythm shift from compression to expansion

🔹 Weekly Rhythm

- Key resistance at $193 has flipped into support

- Bollinger dotted lines breaking upward with increasing slope

- MACD is positive and diverging upward = momentum confirmation

🔹 Daily Rhythm

- Short and mid-term moving averages merged & realigned

- Breakout from consolidation channel ($188–$202) completed

- RSI in bullish zone, MACD crossing confirms a new upward cycle

- Fibonacci extension targets lie ahead in the $230–$280 zone

📌 Core Point ($193.0): Key pivot and breakout base

📌 Dotted Resistance ($217–$222): Primary rhythm barrier; break confirms extended momentum

📌 Trap Potential: Minor pullbacks near $200 are expected—but rhythm holds above $193

3. 📊 Financial Overview

- Market Cap: $67.1B

- Q1 Revenue: $1.04B (+26% YoY)

- Adjusted EPS: $0.24 (Beat estimate of $0.21)

- GAAP Net Loss: $430M (Increased YoY)

- Full-Year Product Revenue Guidance: Raised to $4.325B

4. ⚠️ News & Risks

- Snowflake announced stronger partnerships in AI via OpenAI and Anthropic integrations

- Institutional target prices average at $218.17

- Risks include high valuation, GAAP net loss, and potential rate-related tech corrections

- Short-term overbought signals may cause temporary volatility

5. 🧠 Strategy Scenario (When, Why, How Much)

🎯 Entry Zone

$197.00 ~ $204.50 (Probability: 68%)

→ Recent breakout consolidation zone

→ RSI neutral-bullish, low-risk re-entry near $200

🎯 Targets

- 1st Target: $217.50 (Probability: 68%)

- 2nd Target: $235.00 (Probability: 61%)

- Long-Term Target: $281.00 (Probability: 48%) → Fibonacci extension (1.618 level)

🛡️ Stop-Loss / Response

$192.00 (Probability: 73%)

→ Break below key support would invalidate the bullish rhythm structure

6. 🌈 Outlook

Snowflake has re-emerged as a momentum tech stock with real earnings fuel.

If the current rhythm holds above $200 and volume persists,

we expect the next wave of institutional inflows to push the stock toward the $230–280 expansion zone.

“Price reflects belief.

But rhythm proves conviction.”

7. 🧩 Member-Only Deep Dive

📌 Institutional Flow

- BlackRock, T. Rowe Price increased their exposure post-Q1

- AI-related ETF funds showing net inflows toward SNOW

📌 Short Interest

- Currently at ~3.8%, low but could trigger minor squeeze

- Volatility risk moderate due to high institutional control

📌 Sentiment & Trend Data

- Google Trends: “Snowflake AI” up +290% in the last 30 days

- Analyst upgrades from JPMorgan, Goldman Sachs post-earnings