#QuantumBioPharma #QNTM #BiotechStocks #NASDAQ #ClinicalPipeline #SwingTrading #PriceTrap #ElliottWave #StockForecast #VolatileStock #RhythmAnalysis #TechnicalStrategy #InstitutionalFlow #FDAApproval #BiotechMomentum

Hello, this is JinLog, your top trader and market analyst.

This video includes both technical analysis and strategy breakdowns.

You can also find a blog-format summary of this report for quick reference.

4. Summary

Quantum BioPharma is currently in a rhythm contraction with a price trap in place, showing strategic opportunities at swing and mid-term price zones.

- Short-term trend: Breakdown → Trap at 0/3 phase

- Swing trend: Maintained with rhythm contraction → Entry range: 17 ~ 18.82

- Mid-term trend: Sustained → Rhythm expansion → Strategic entry at 15

📌 Note: The short-term price target of 25 was reached on June 17. Further movement depends on rhythm recovery.

5. Investment Outlook

- Short-term: Trap phase active; reentry only after rhythm recovery

- Swing: Trend intact; monitor for rhythm and flow reversal

- Mid-term: Expansion trend with potential for a strong move

6. Chart Explanation

📌 (Standard Commentary)

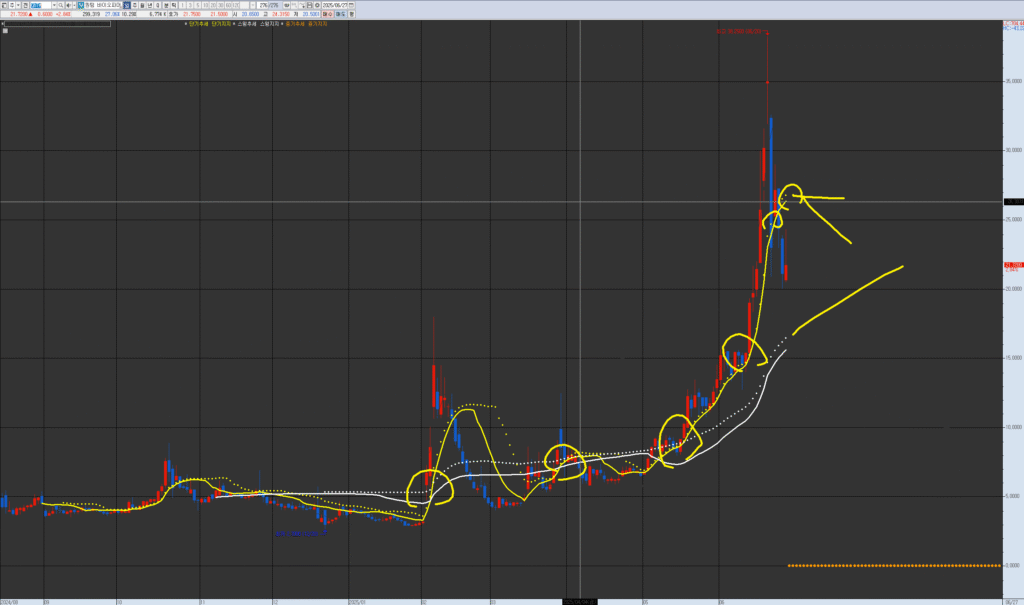

“This is the chart of Quantum BioPharma.

Past and current circled areas show trend merges and bullish structures.

Entries near the swing or mid-term lines are historically higher probability zones.

Be sure to track rhythm and wave flow on each chart.”

7. Rhythm Analysis

- Short-term Rhythm: Contracting with 0/3 trap structure; direction undecided

- Swing Rhythm: Contracting but trend intact; watch entry at 17 ~ 18.82

- Mid-term Rhythm: Expanding; signals breakout potential if continuation occurs

8. Financial Overview

- Zero revenue; trailing net loss of ~$20.88M

- Debt ratio around 28% → financially stable

- Cash burn (Q1): Op CF –$1.48M / Levered FCF –$5.12M

- Subsidiary Unbuzzd actively raising capital for pipeline advancement

9. News / Risk / Events

- June: Private placement led by insiders (MVS shares)

- Subsidiary Unbuzzd launching Reg D funding pre-IPO

- Clinical progress on Lucid-MS and FSD202

- $700M class-action lawsuit over alleged market manipulation

- Crypto assets (~$4.5M) held for staking & yield generation

10. Strategy Scenarios

✅ Short-term Buy Strategy

- Entry Zone: (if recovered) 20.5 ~ 22.2

- Condition: Trap phase cleared (2/3) + rhythm recovery + supply flow reversal

✅ Swing Buy Strategy

- Entry Zone: 17 ~ 18.82

- Condition: Trap 2/3 resolved + rhythm & demand flow shift

✅ Mid-term Buy Strategy

- Entry Zone: 15

- Condition: Confirmed rhythm expansion + strong accumulation flow

11. Elliott Wave Analysis

- Current Position: Wave 2 corrective phase

- Scenario: Entry build-up before potential Wave 3

- Wave Interpretation:

- Wave 1 Peak: 25 (already reached)

- Wave 2 Pullback Zone: 17 ~ 18.82

- Wave 3 Target: 30 ~ 35 range possible

12. Community Sentiment

| Platform | Keywords | Sentiment | Summary |

|---|---|---|---|

| $QNTM, Lucid, Unbuzzd | Optimistic + Cautious | “Insider buys seen as positive. IPO hype growing.” | |

| StockTwits | #QNTM, #FSD202 | Trap-focused | “Post-25 drop caused caution. Awaiting reversal.” |

| $QNTM, MS Drug | Hopeful + Volatile | “MS therapy hopeful, but short-term dips expected” |

13. Forecast & Risk Summary

- Forecast: Potential for breakout if Wave 3 begins

- Risks: Clinical failure, delayed IPO, lawsuit outcomes

- Supply/Demand: Insider-led capital inflow; no major institutional accumulation confirmed

- Tech Indicators: Rhythm recovery is the key trigger

14. Advanced Report

- Institutional Flow: Not detected

- Social Mentions: Reddit mentions up 130%

- Short Interest: Not disclosed, but spread widening detected

- AI Flow Models: Weak inflow post-June; recovery expected in July

15. Legal Notice

This report is based on the VPAR Rhythm Analysis System.

All rhythm, flow, and scenario interpretations are for educational purposes.

Investment decisions should be made at the sole discretion of the investor.