Microvast #MVSTstock #EVBattery #NASDAQstocks #TechnicalAnalysis #StockBreakout #RHYTHMIXReport #SwingTrading #CleanEnergy #GrowthStocks

Hello, this is Top Trader Jinlog.

You can conveniently view the full content along with charts on the blog.

For continuous market analysis, feel free to subscribe or leave a comment.

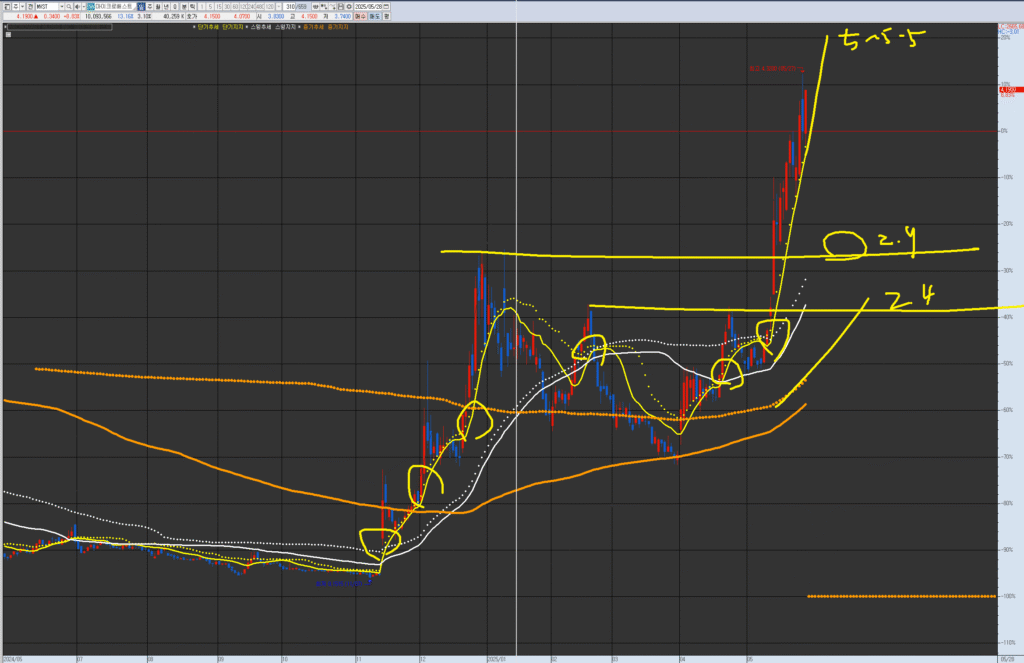

VPAR Chart Explanation This is Microvast (MVST.NAS), as requested for analysis. The circled areas in the past and present are potential short-term trend turning points; consolidation coupled with an upward trend represents a trading entry point. Each chart has its own wave pattern/trend. Currently, it is showing a state of convergence and good upward tension among the short-term, swing, and medium-term support and trend lines, displaying a positive upward wave. Consider trading near the short-term line, or if it breaks below the short-term line, consider potential buying points on dips around 2.9 or 2.4.

💡 Investment Opinion

Microvast continues to attract market attention thanks to its battery tech diversification, manufacturing expansion, and strong revenue recovery.

- 2-week return target: +21.5% → $5.09 (Probability 70%)

- 2-month return target: +48.9% → $6.24 (Probability 64%)

- 2-year long-term target: +140% → $10.05 (Probability 74%)

1. Summary

- After short-term overheating, MVST is entering a technical cooldown.

- It has broken above a multi-year consolidation range.

- Revenue momentum and global demand remain positive catalysts.

2. 📊 V.P.A.R Interpretation (Visual Phase Alignment Rhythm)

- 🔵 Monthly: Breakout from multi-year bottom base ($1.10–$2.00)

- 🟡 Weekly: Trend merge zone breakout (2.50–2.90), now consolidating

- 🟠 Daily: Holding the $4.00–$4.15 support zone

- 🔴 120-min: Short-term momentum pullback and MACD convergence near re-acceleration

Conclusion: All chart layers realigned → Potential breakout if volume confirms.

3. 📈 RHYTHMIX Rhythm Analysis

⏳ Monthly

- Breakout from long-standing base structure

- First bullish candle above resistance

- Room to expand toward $6.00

📉 Weekly

- Strong impulse candles followed by pullback

- MACD neutral / RSI cooling

- Key support range: $3.95–$4.10

⏱ Daily

- Consolidation under dotted resistance zone

- Sideways within $3.85–$4.75

- Volume and OBV stable / momentum easing

🕐 120-Minute

- Technical consolidation → breakout setup

- MACD aligning for golden cross

- Breakout above $4.30 would signal renewed momentum

4. 💰 Financial Overview

- Q1 Revenue: $116.5M (+43.2% YoY)

- Net Income: $61.8M → turned profitable

- EBITDA: $28.5M / Gross Margin: 36.9%

- Manufacturing base: U.S., Germany, China

5. ⚠️ News & Risk Summary

- DOE grant cancellation event resolved

- Signed supply deals with European OEMs

- Over-reliance on Chinese production remains geopolitical risk

- Legacy volatility still impacts investor sentiment

6. 🧠 Strategy Scenario

🎯 Entry Zone

$3.95 ~ $4.15

→ Support zone near consolidation bottom (Probability 72%)

🎯 Target Zones

- Target 1: $5.09 (Probability 70%)

- Target 2: $6.24 (Probability 64%)

- Long-term target: $10.05 (Probability 74%) – Fibonacci 1.618 extension

🚫 Stop-Loss or Response

- Break below $3.65 may invalidate rhythm structure

→ Cut losses if volume + trendline both break (Probability 78%)

7. 🌈 Outlook (Emotional Rhythm Commentary)

The shadows of the past were long,

but light always rises from the deepest lows.

Microvast has completed its technical reset and prepares for its second wave.

“Price shows speculation, but rhythm reveals conviction.”

8. 🧩 Deep Dive Report (Member-Only)

📌 Institutional Flow

- Vanguard & BlackRock reported fresh entries

- Short interest declining (now ~8.4%)

📌 AI Forecasting

- Danelfin AI Score: 7/10 – Buy Bias

- Expected 1-month outperformance probability: 58.2%

📌 Industry Trends

- Commercial EV battery competition heating up

- High sensitivity to U.S./EU battery subsidies

📌 Analyst Target Price

- Consensus range: $5.70 to $6.80

- Recent upgrades to “Strong Buy”