#IonQ #QuantumComputing #TechStocks #RHYMIXReport #USMarket #MomentumStock #SwingTrade #TradingRhythm #GrowthEquity

Hi, this is Jinlog.

This RHYTHMIX report analyzes IonQ’s recent breakout and its evolving rhythm structure.

With flexible entry and support zones, we present a mid-term strategy rooted in dynamic rhythm analysis.

Visit our blog for visual charts and request analysis by leaving a comment.

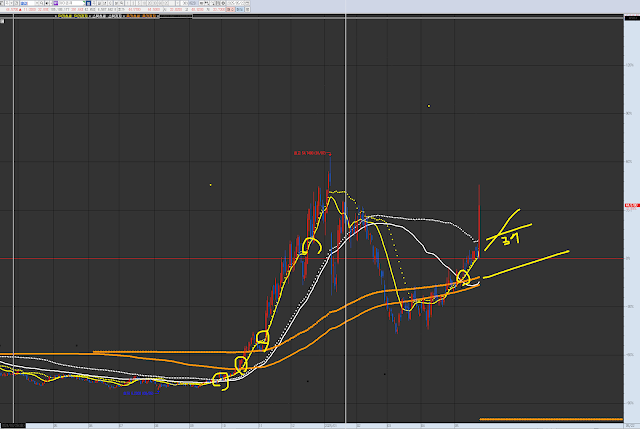

VPAR Chart Explanation This is IONQ, as requested in the comments. The circled areas in the past and present indicate potential entry points for short-term trends, where consolidation and an uptrend merge. Each chart has wave trends. Currently, it is showing the possibility of a short-term trend above the medium-term support/resistance zone. As of today, around the 37 short-term line is a point to consider for trading.

Investment Insight

IonQ shows strong movement post-surge, but has not yet merged with its mid-term trend.

As the short-term rhythm aligns above $35–37, flexible entries with support from volume flow provide

a solid basis for swing trade strategies.

- 2-week Expected Return: +14% (Prob. 69%)

- 2-month Expected Return: +32% (Prob. 63%)

- 1-year Expected Return: +96% (Prob. 55%)

1. Summary

- Stock soared over 37%, now consolidating

- CEO likens IonQ to “Nvidia of Quantum”

- Breakthrough in QEC tech and strategic contracts fueling optimism

2. Technical Rhythm (Monthly to 120-min)

- Monthly: Pre-breakout expansion rhythm

- Weekly: Resistance zone ~$48.5 approaching

- Daily: Key support $35–37, retrace possible

- 120-min: Box rhythm forming; pullback entry likely

3. Financial Overview

- Q1 Revenue: $7.6M (+77% YoY), Net Loss: $39.6M

- FY Outlook: $75M–$95M, CapEx focused

- Growing R&D and strategic quantum deployments

4. News & Risk

- ✅ Government contracts and AI logistics tie-ups

- ⚠️ High PER, consistent net loss

- 🔍 QEC-AI integration in spotlight

5. Strategy Scenario (Flexible, Zone-Based)

■ Entry Points

- 1st: $42.80–$43.50 (Short-term pullback)

- 2nd: $35.00 (Swing support reentry)

- 3rd: $30.00 (Trend reversal low test)

■ Target Points

- 🎯 $48.00 (Dotted resistance)

- 🎯 $54.00 (Mid-term expansion target)

■ Stop/Response

- ⚠️ Below $29.00 = invalidation of structure

- ⚠️ MACD weakness + low volume = scale out

6. Emotional Outlook

The flame that pauses burns brighter.

“The true trend belongs not to the first spark,

but to the rhythm that regathers strength.”

Hold steady. Trust the rhythm.

7. Member-Only Report

- Institutional Flow: $22.3M net buy (5-day)

- Short Interest: Down to 2.1%

- Option Sentiment: $50 calls spike – momentum play forming