GryphonDigitalMining #GRYP #BitcoinMiningStocks #RhythmReport #TopTraderJinlog #CryptoStocks #AltcoinMining #RhythmAnalysis #USStocks #MicroCapStocks #Bitcoin #ETF #EnergyStocks #MiningStock

Hello, this is TopTrader Jinlog.

You can check the details along with the chart on my blog.

If you want continuous analysis, please subscribe or leave a comment.

If you want to receive reports quickly, please choose the priority option.

Summary

✅ Is there a chance for a short-term breakout in the current rhythm? Let’s analyze now.

GRYP recently surged 442% in May following Bitcoin’s rally and the American Bitcoin merger news,

and is now forming a box consolidation phase after the breakout.

Chart review:

- 60-min: Upper box trap → retracement → re-testing box top

- Daily: Peak trap → consolidation near Bollinger middle band

- Weekly: Breakout from lower box → strong bullish candle → mid-consolidation

- Monthly: Breakout from major low → large bullish candle → possible correction phase

Conclusion: Currently consolidating after high volatility;

box re-acceleration is possible, but confirming support at the center of the box is key.

1️⃣ Investment Opinion

📌 Short-term: Box consolidation → watch for buy-the-dip opportunities

📌 Mid-term: High volatility phase → valid re-acceleration if box center holds

📌 Strong correlation with Bitcoin, potential repeat breakouts on news triggers

→ Performance Expectation

- 2-week target: +15.4% → $1.35 (Probability 60%)

- 2-month target: +42.7% → $1.67 (Probability 65%)

- 2-year long-term target: +218.8% → $3.73 (Probability 70%)

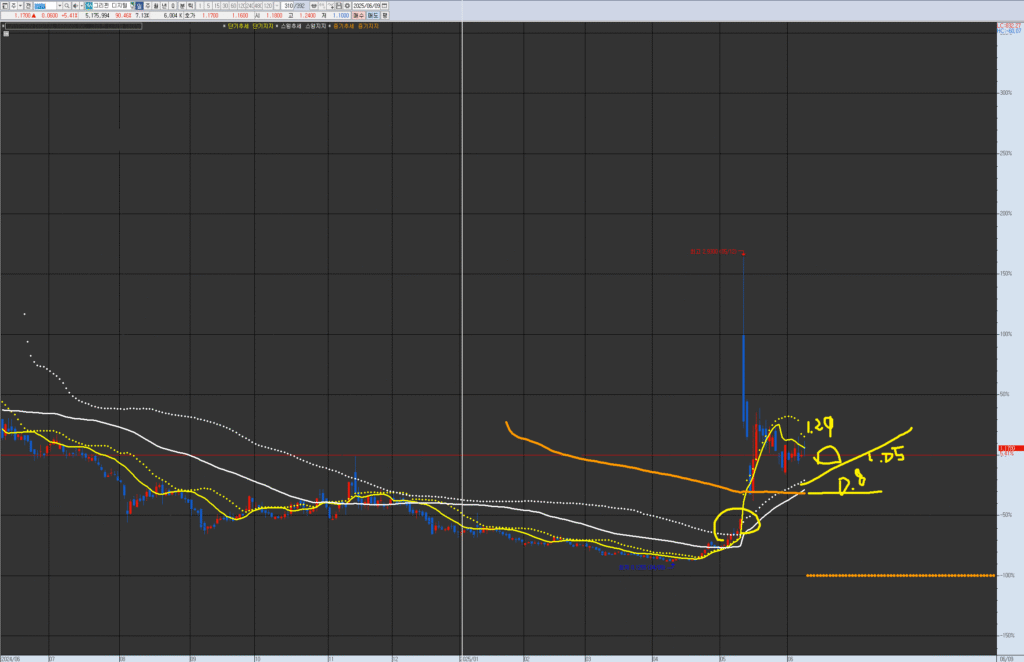

VPAR Chart Explanation This is Gryphon Digital Mining (GRYP), as requested for analysis. The circled areas in the past and present are potential short-term trend (yellow) consolidation and upward trend points. These points have a higher probability and potential return when they are near the swing line (white) or medium-term line (orange). Each chart has its own wave trend and tension. Currently, after breaking through the medium-term resistance/supply, it is above the swing trend (weekly wave). While observing the process of absorbing short-term supply, consider it a point for potential swing entry. For specific entry points, please refer to the strategy scenario and report.

3️⃣ VPAR Rhythm Analysis

Monthly

- Rhythm: Breakout from major low box → large bullish candle → potential correction

- Bands: Exceeded upper dotted band → returning to box

- MACD: Bullish reversal → mid-term strength remains

Weekly

- Rhythm: Lower box breakout → bullish trap → consolidation

- Bands: Approaching upper box → testing center support

- RSI: Cooling down after overbought

Daily

- Rhythm: Peak trap → testing Bollinger middle band

- Bands: Center test in progress

- MACD: Bearish divergence → short-term pullback underway

60-min

- Rhythm: Upper trap → mid-box consolidation

- Volume: Declining after spike → preparing for next move

- Trap: Watching for recovery from recent trap

4️⃣ Financials

- Q4 mining revenue: +4.2% → $3.85M

- Net profit: $0.4M → turned positive

- Debt reduction: $13M Anchorage debt converted to equity

- Cash: $0.735M → liquidity risk remains

5️⃣ News & Risk Summary

News

- American Bitcoin merger: Triggered 285% rally

- Captus Energy acquisition: Building 4GW green mining infrastructure

- Mining capacity expansion: +22% planned

Risks

- Q1 EPS –0.089 → missed expectations

- Insider selling (~$441K)

- Ongoing net loss → FFO negative

6️⃣ Strategy Scenario

🎯 Entry

- Buy in the $1.10 ~ $1.15 range

🎯 Targets

- 1st target: $1.35 (Probability 60%)

- 2nd target: $1.67 (Probability 65%)

- 3rd target (Long-term): $3.73 (Probability 70%)

🚫 Stop-Loss

- Below $1.05 → trim half

- Below $0.88 → full exit

7️⃣ Outlook

Currently in a high-volatility box with potential for re-acceleration.

Since this stock is highly sensitive to Bitcoin price and news triggers,

confirming support at the box center is essential before taking positions.

“The next breakout timing after this consolidation is key.”

8️⃣ Deep Report

- Institutional flow: Primarily volatility players, limited institutional positions

- Short interest: ~3.2%, decreasing trend

- Social trends: Keywords surging — “merger,” “American Bitcoin,” “crypto mining,” “breakout stock”

✅ Summary

GRYP remains in a high-volatility rhythm with valid breakout potential.

Strong correlation with Bitcoin and merger news could trigger the next surge.

Watch the box center level for optimal buy entry.