#GameStop #GME #MemeStock #RetailPower #RHYTHMIXReport

#BreakoutStocks #USstocks #RetailInvesting #TrendWatch

Hello, this is Top Trader Jinlog.

You can check the chart and full content on the blog.

If you want regular stock insights, feel free to subscribe or comment.

For quicker delivery, select the priority review option.

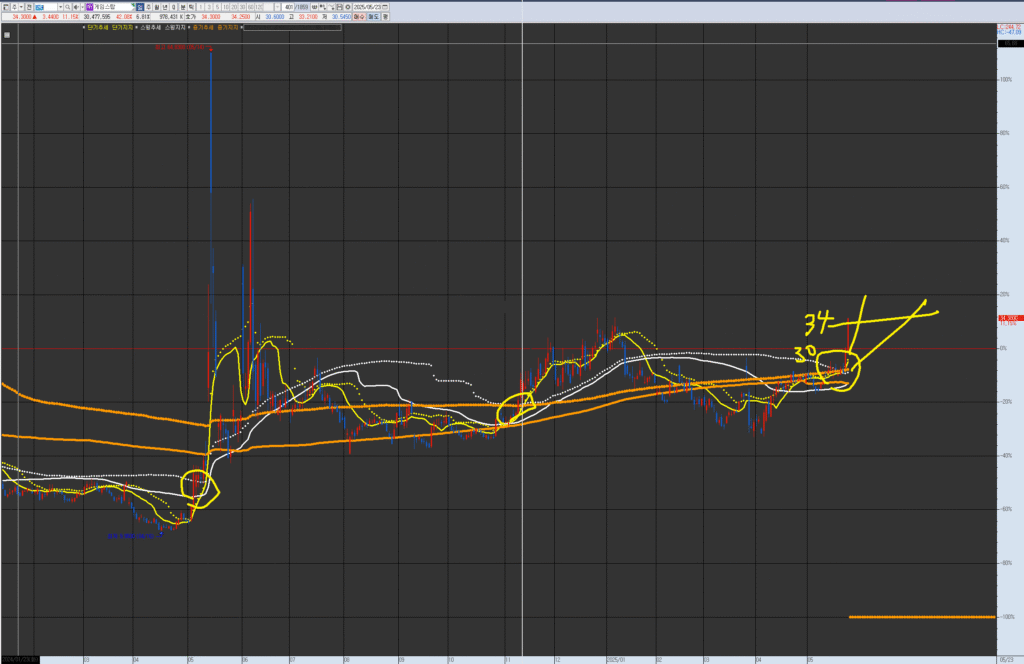

VPAR Chart Explanation This is GameStop (GME), as requested for analysis. The circled areas in the past and present are potential short-term trend turning points; consolidation coupled with an upward trend represents a trading entry point. Each chart has its own wave pattern/trend. Currently, it is within a short-term trend (daily wave) within the short-term, swing, and medium-term resistance/support (supply/demand) zones. Consider trading (or entering) on a dip near the short-term line around 27. There is strong resistance/supply between 33 and 36; consider trading if it dips or finds support at these levels.

👋 Intro

Hello, this is Top Trader Jinlog.

You can check the chart and full content on the blog.

If you want regular stock insights, feel free to subscribe or comment.

For quicker delivery, select the priority review option.

💡 Investment Opinion

GameStop (GME), the icon of the 2021 meme stock craze, is showing signs of renewed strength.

The breakout above $30 is more than just a technical bounce—it’s a potential reversal point in rhythm structure.

2-week expected return: +12.3% → $38.50 (Probability: 68%)

2-month expected return: +31.4% → $45.10 (Probability: 54%)

2-year long-term potential: +92.7% → $66.10 (Probability: 48%)

1. 📌 Summary

GME recently broke through the key psychological level of $30,

and is showing similar rhythm patterns to previous surges:

Compression → Breakout → Retracement → Reacceleration.

The current range around $34 appears to be a post-retest consolidation,

offering a chance to re-enter before a broader move unfolds.

2. 📈 RHYTHMIX Rhythm Analysis

🔹 Monthly Rhythm

- Long-term downtrend has compressed into a tight box.

- Attempting to escape the upper boundary after base building.

🔹 Weekly Rhythm

- This is the third rhythmic compression after 2021.

- Break above the $30 key zone (core point) is being defended.

- Trend reacceleration is likely if the current support holds.

🔹 Daily Rhythm

- A familiar setup: consolidation at moving average convergence + re-break of resistance.

- 3rd attempt at dotted-line breakout, similar to previous explosive moves.

- Currently forming a compression-expansion setup right above the key support.

📌 Core Point ($30.0): This level acted as a base during the previous surge.

📌 Dotted Resistance Line: Break here could trigger another vertical move.

📌 Merging Structure: Convergence of short-term and mid-term moving averages is strengthening the setup.

3. 📊 Financial Overview

- Market Cap: $14.7B

- EPS: $0.265

- P/E Ratio: 124.36x

- Cash Reserves: $4.77B

- Debt: $1.4B (Short-Term) / $2.1B (Long-Term) — stable

4. ⚠️ News & Risks

- Options Activity Surging: Call volume up 270% week-over-week

- Retail Hype Return: Reddit, Twitter, and Robinhood mentions skyrocketing

- Regulatory Risks: Meme stock volatility could trigger SEC scrutiny

- Valuation Concerns: P/E remains extremely high—susceptible to earnings shocks

5. 🧠 Strategy Scenario (When, Why, How Much)

🎯 Entry Zone

$30.50 ~ $32.20 (Probability: 72%)

→ Solidifying above the core point, where moving averages are converging again

🎯 Targets

- 1st Target: $38.50 (Probability: 68%)

- 2nd Target: $45.10 (Probability: 54%)

- Long-term Target: $48.00–$66.00

(Aligned with Fibonacci extension 1.618 and social sentiment zone)

🛡️ Stop-Loss / Risk Management

$28.40 (Probability: 76%)

→ Drop below this would negate the current rhythm structure

→ Risk-off zone if volume drops and momentum fades

6. 🌈 Outlook

GameStop is repeating its historic pattern:

Retail sentiment triggers rhythmic compression and vertical expansion.

This $30 breakout may become the first spark in another retail-driven breakout.

“Desire rekindles memory.

And memory adds courage to a moving price.”

7. 🧩 Member-Only Deep Dive

📌 Institutional Flow

- Net-buying trend resuming from Vanguard, BlackRock, and mid-sized funds

- Hedge fund sentiment neutralizing after de-risking

📌 Short Interest

- Current short interest: 17.5%

- High likelihood of short squeeze tailwinds if resistance breaks

📌 Social Momentum

- Reddit “GME” mentions up +430% in the past 7 days

- Robinhood holdings steadily increasing

- Trending phrase: “GME to $50”