Coupang #CPNG #RhythmReport #TopTraderJinlog #USStocks #Ecommerce #TechStocks #PlatformStocks #GrowthStocks #Fintech #RhythmAnalysis #OTT #CoupangPlay #StockMarket #Investing

Hello, this is TopTrader Jinlog.

You can check the details along with the chart on my blog.

If you want continuous analysis, please subscribe or leave a comment.

If you want to receive reports quickly, please choose the priority option.

Investment Opinion

📌 Short-term: Wait and buy on dips → Focus on rhythm consolidation phase

📌 Mid-term: Upward trend potential remains valid

📌 Likely to repeat breakout phases driven by news/policy catalysts

→ Performance Expectation

- 2-week target: +4.2% → $29.65 (Probability 60%)

- 2-month target: +12.5% → $32.00 (Probability 70%)

- 2-year long-term target: +52.8% → $43.50 (Probability 80%)

2️⃣ Summary

✅ Where is the key rhythm zone this time? Check the points below.

Coupang recently entered a re-acceleration attempt phase after a 52-week high breakout and slight pullback.

Technically, both monthly and weekly charts show a consolidation at the upper rhythm box, with an attempt to expand upward.

Fundamentally, improving EBITDA margins, share buyback news, and OTT growth support the mid-term bullish momentum.

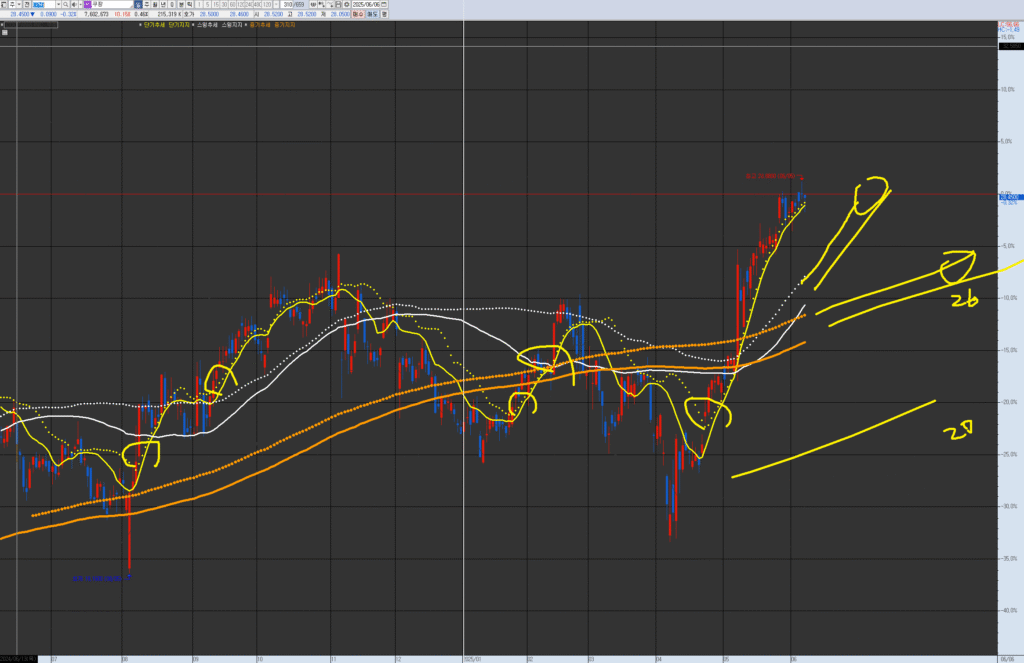

VPAR Chart Explanation This is the Coupang chart (CPNG), as requested for analysis. The circled areas in the past and present are potential short-term trend (yellow) consolidation and upward trend points. These points have a higher probability and potential return when they are near the swing line (white) or medium-term line (orange). Each chart has its own wave tension and trend. Currently, it has clearly transitioned to a long-term trend (yearly wave) since April 2024 and is showing an upward-sloping box pattern centered around the medium-term resistance/supply. When the short-term/swing deviation correction is complete, there is a possibility of a sharp upward move (“shooting”) if an event occurs. If it breaks below (the current support/box), consider it a point to enter the medium-term resistance/supply box.

3️⃣ VPAR Rhythm Analysis

Monthly

- Rhythm: Testing upper box trap zone → Watching for re-acceleration

- Bands: Approaching upper dotted band → Expansion potential remains valid

- Momentum: RSI/MACD holding strong → Mid-term bullish

Weekly

- Rhythm: Box breakout → Current consolidation

- Bands: 20EMA / 60EMA in bullish alignment → Ready for further upside after pullback

- Volume: Consistent inflow → Bullish signal

Daily

- Rhythm: Rise → Consolidation → Early re-acceleration

- Bands: Mid-box consolidation, upper test ongoing

- MACD: Bullish crossover → Re-buy zone approaching

60-min

- Rhythm: Failed breakout → Currently consolidating within short-term box

- Volume: Decreasing → Momentum rebuilding needed

- Trap: Upper trap formed, no full pullback → Re-entry valid

4️⃣ Financials

- Revenue growth continues ($7.9B, +11%)

- EBITDA margin improved to 4.8%

- Net profit positive ($154M)

- Strong liquidity ($6.0B cash)

5️⃣ News & Risk Summary

News

- $15B credit secured → Enhances growth flexibility

- $1B share buyback → Supports shareholder value

- Coupang Play showing strong growth → Expanding OTT base

Risks

- Insider selling reported → May cause short-term sentiment dip

- Global expansion costs increasing

6️⃣ Strategy Scenario

🎯 Entry

- Buy in the $27.80 ~ $28.20 range

🎯 Targets

- 1st target: $29.65 (Probability 60%)

- 2nd target: $32.00 (Probability 70%)

- 3rd target (Long-term): $43.50 (Probability 80%)

🚫 Stop-Loss

- Below $26.90 → Trim half position

- Below $25.50 → Full exit

7️⃣ Outlook

A new re-acceleration phase is unfolding after consolidation.

The mid-term bullish momentum remains valid, supported by fundamental drivers.

Watch the next 2–4 weeks for potential breakout above key resistance zones.

8️⃣ Deep Report

- Institutional flow: Foreign net buying continues, institutional selling slowing

- Short interest: Reduced to ~1.1%

- Social trends: Positive keywords on “Coupang Play”, “share buyback”, “52-week high”

✅ Summary

Coupang remains in a mid-term bullish rhythm.

Current phase offers a buy-the-dip opportunity, with potential for re-acceleration in coming weeks.