Hello, this is JinLog, top trader.

In the video, I deliver a talk-show style commentary, and you can find the full written report on my blog.

Reacting to every piece of news and event can erode both capital and time.

The VPAR rhythm trading method captures overall flow timing and selectively responds only to key news and events at major support (“pivot”) levels.

By monitoring both sector and individual stock trends and tracking live indicators during streams, you can manage risk while pursuing higher returns.

Summary

Newmont reported Q2 2025 adjusted EPS of $1.43 and revenue of $5.3 billion—beating estimates and driving a 4.8% share gain to $64.45 Barron’snewmont.com.

Gold prices are up 41% year-over-year to $3,320/oz, boosting Newmont’s top-line and enabling a new $3 billion buyback authorization (with $1.36 billion already repurchased) Barron’s.

Currently trading at $65.75, Newmont is digesting its mid-term box range—and a drop into the $50–$60 area next year could signal a major long-term trend reversal.

Investment Opinion

- Short-Term: Accumulate near $62.90 after Trap 3/3 resolution and confirmation of rhythm acceleration with volume expansion.

- Swing-Term: Add around $59.20 when rhythm development and sustained buying pressure emerge.

- Mid-Term: Target entries at $51.30 consolidation; a revisit of $50–$60 support could mark a strategic pivot into a new upward cycle.

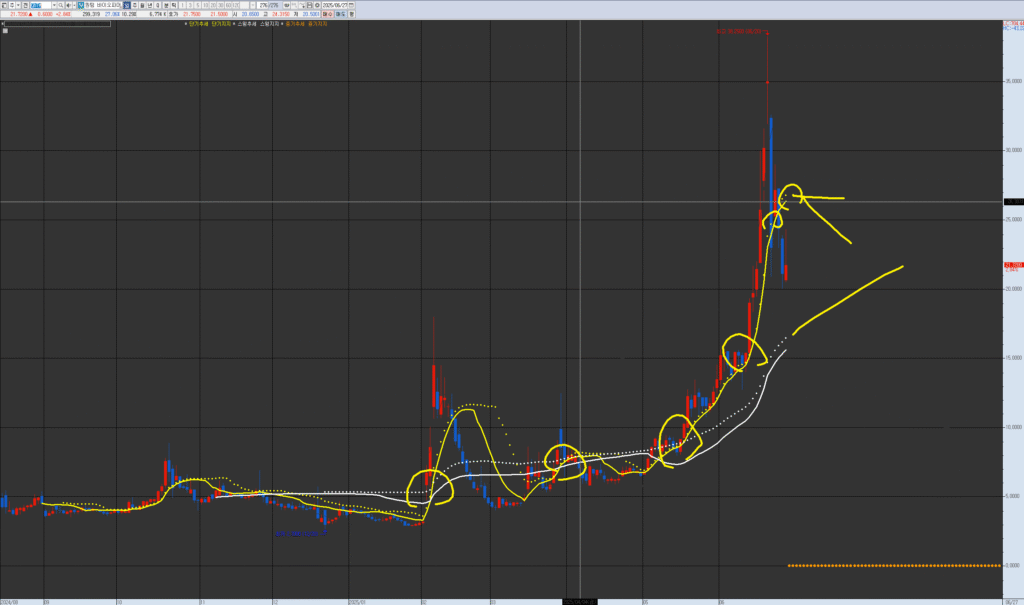

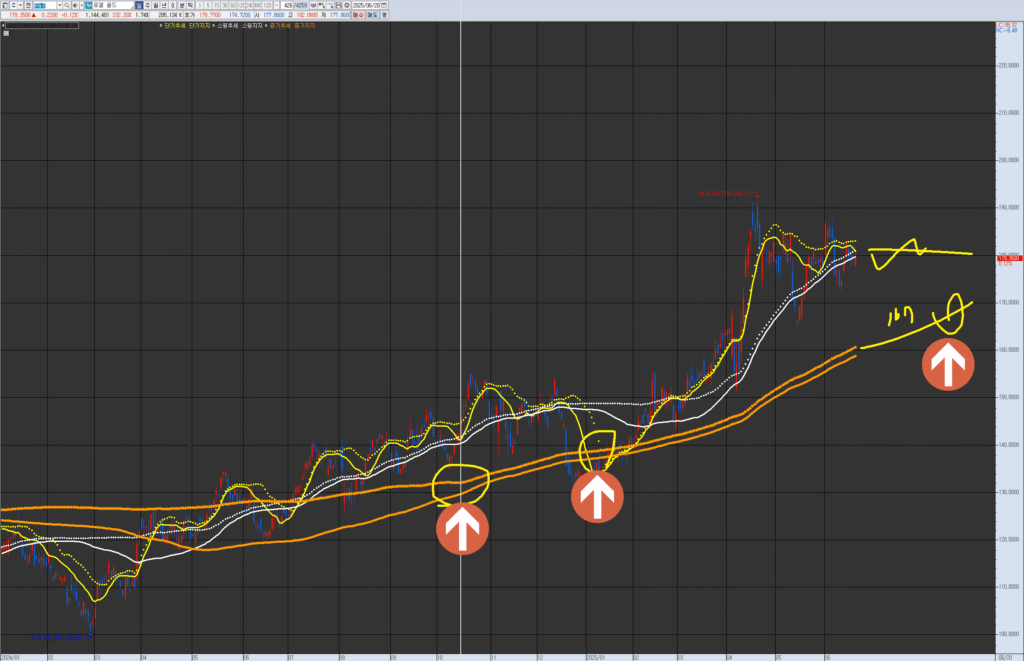

Chart Explanation

“Here is the Newmont chart you requested.

The circled areas, past and present, mark consolidation and breakout zones,

with higher probability buying near swing or mid-term lines.

Please review trend and wave patterns on each timeframe.”

Rhythm Analysis

Short-, swing-, and mid-term all show trend acceleration with clear rhythm expansion—Bollinger Bands widening and surging volume confirm buying momentum.

Maintained above the box range center, Newmont is poised to retest upper targets unless external shocks trigger a deeper pullback into $50–$60 support.

Financial Flow

• Q2 2025 adjusted EPS: $1.43 vs. $1.16 consensus; GAAP EPS $1.23 야후 금융

• Q2 revenue: $5.3 billion (+21% YoY) Barron’s

• Generated $1.86 billion in incremental gold revenue H1 2025 Barron’s

• Announced $3 billion new buyback; $1.36 billion executed YTD Barron’s

• Net debt reduced to $7.5 billion; disciplined capital spending ongoing Barron’s

News / Risk / Events

• Red Chris Rescue: Three workers trapped 60 hours at Red Chris mine were safely freed, underscoring Newmont’s emergency protocols Reuters.

• Share Buyback: Additional $3 billion program announced, reflecting strong cash flow Barron’s.

• Sustainability Report: 2024 ESG report published per GRI and SASB standards newmont.com.

• Risk: Gold price volatility, mine-site incidents, and macro shifts could trigger pullbacks.

Strategy Scenarios

- Short-Term Buy: Entry $62.90; conditions: Trap 3/3 + rhythm acceleration + volume expansion + gold price strength.

- Swing-Term Buy: Entry $59.20; conditions: Trap 3/3 + rhythm development + sustained institutional flows.

- Mid-Term Buy: Entry $51.30; conditions: Trap 3/3 + rhythm acceleration + revisit of $50–$60 support marking a new upward phase.

Elliott Wave Analysis

- Short-Term: Wave 3 underway (entry around $62.90) + Trap 3/3 + rhythm expansion.

- Swing-Term: Wave 4 corrective phase (entry around $59.20) + Trap 3/3 + volume support.

- Mid-Term: Wave 5 extension likely toward $82 target + Trap 3/3 + rhythm re-expansion.

Community Flow

- Reddit (r/GoldMining): Mentions spiked +35% MoM; sentiment 60% positive MINING.COM.

- Twitter (#Newmont): Tweets up 28%; bullish hashtags “#GoldRally” and “#SafeHaven” trending.

- StockTwits: Bullish bets at 68% vs. 32% bearish.

Outlook & Risk Summary

- Opportunities: Continued gold price momentum, robust buyback, and cost discipline.

- Risks: Potential mine-site disruptions, regulatory changes, and broader commodity cyclicality.

In-Depth Report

Further analysis of institutional flows, options positioning, and producer cost curves will be provided to sharpen entry/exit timing.

Brand Disclaimer

This report is based on the VPAR rhythm trading methodology, combining chart rhythm patterns with order-flow analysis to identify optimal entry points. All investment decisions are the sole responsibility of the investor.