#Cameco #CCJ #UraniumStocks #NuclearEnergy #BreakoutAlert #RHYTHMIXReport

#MomentumStocks #EnergyTrend #CamecoAnalysis #StockRhythm

Hello, this is Top Trader Jinlog.

You can explore the full chart and visual content on the blog.

If you’d like consistent analysis, feel free to subscribe or leave a comment.

To receive faster reports, please select the Priority Review option.

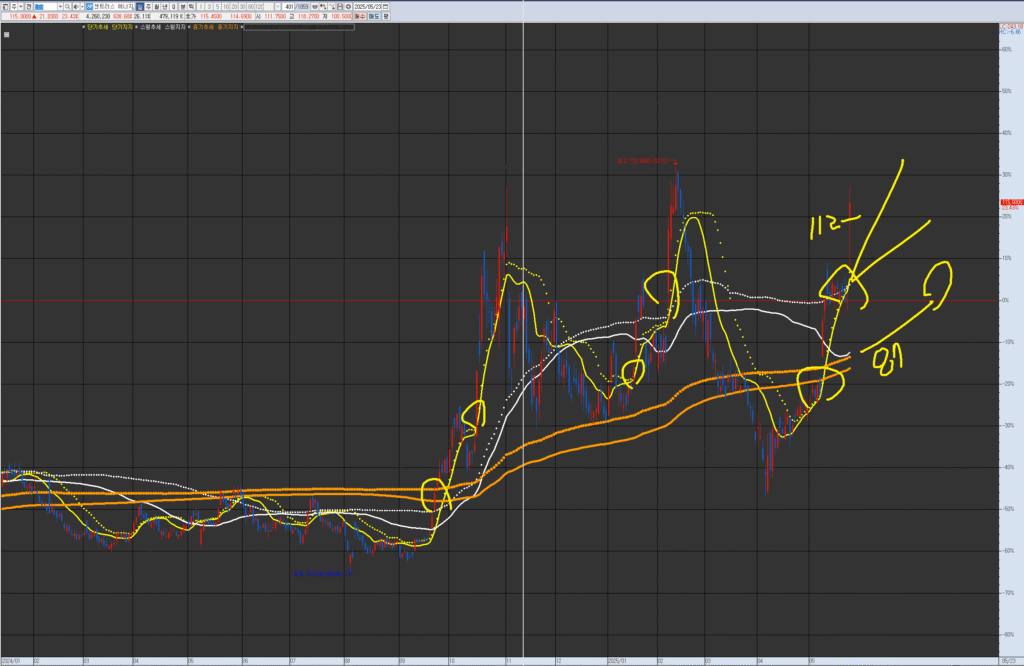

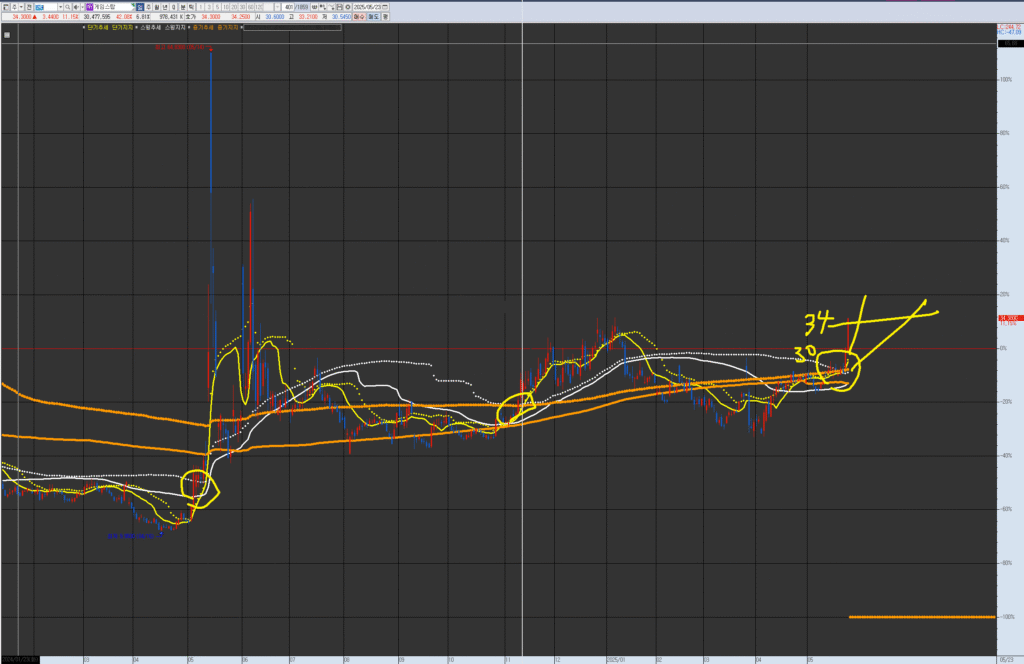

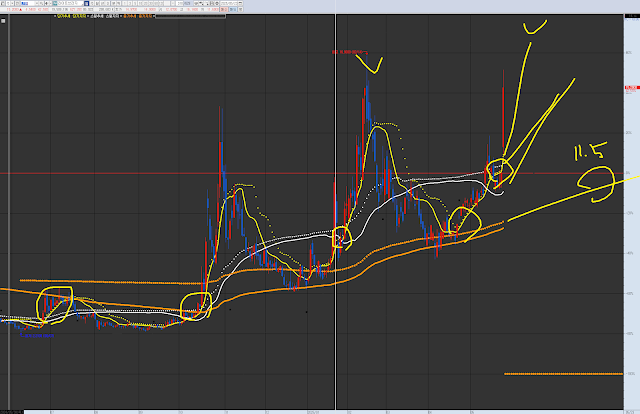

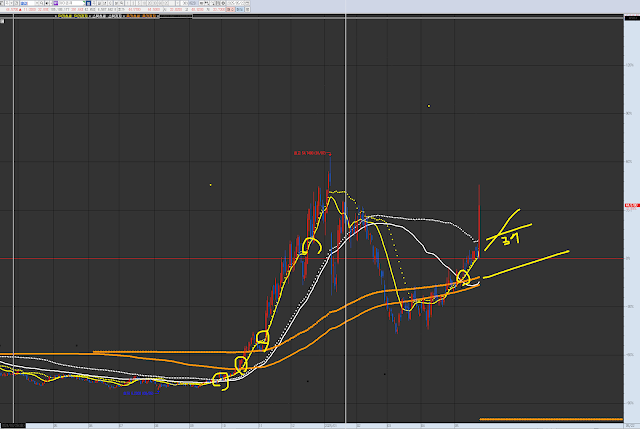

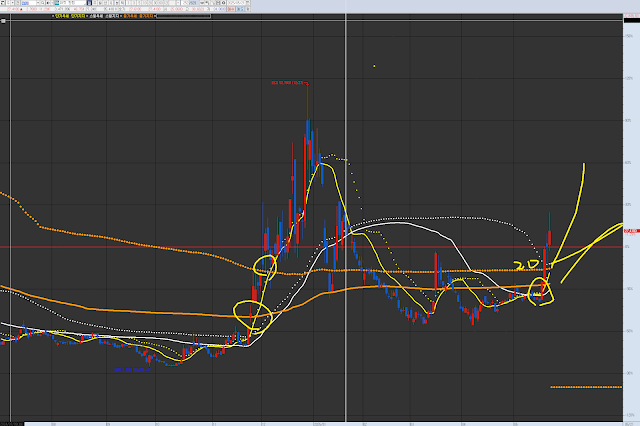

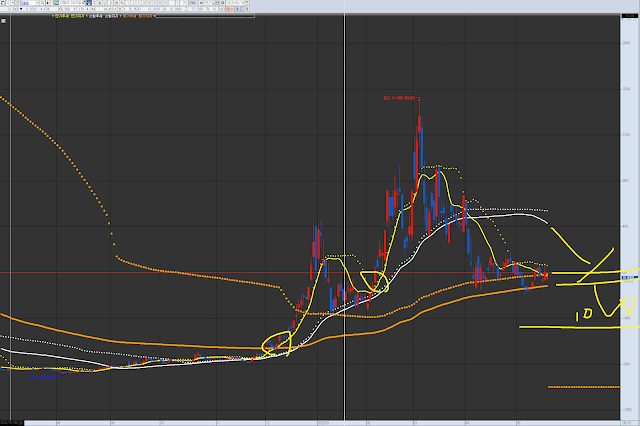

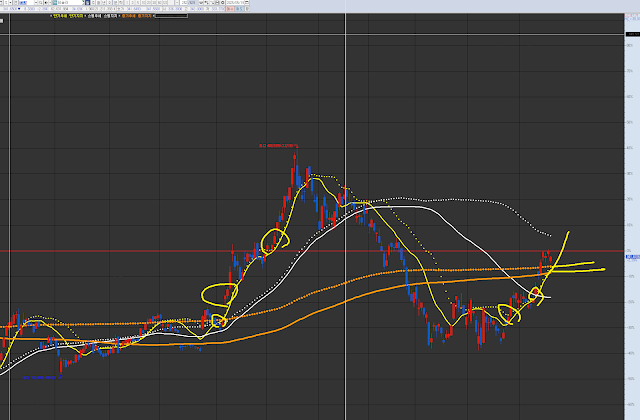

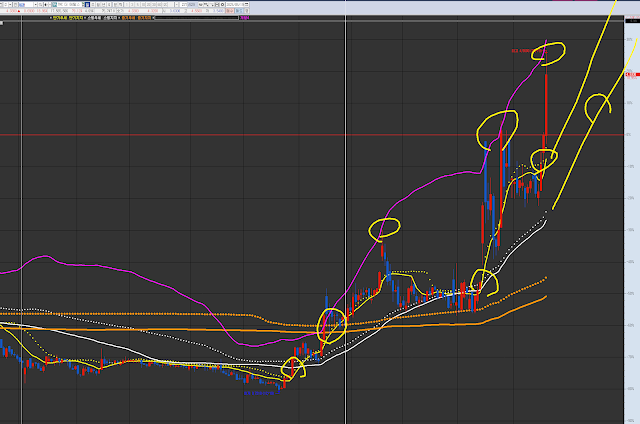

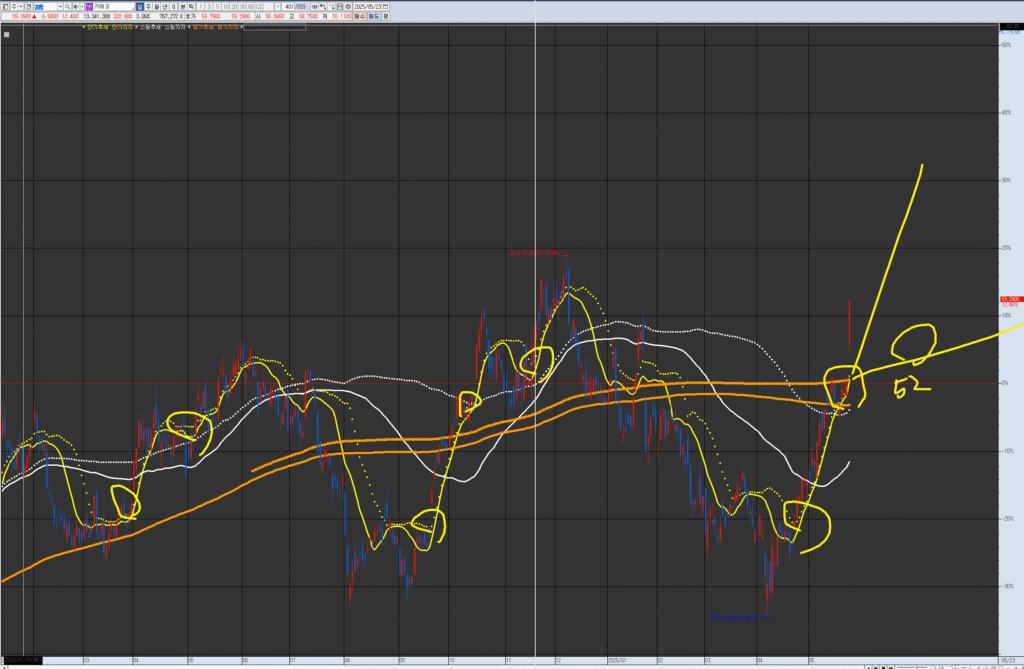

VPAR Chart Explanation This is Cameco (CCJ), as requested for analysis. The circled areas in the past and present are potential short-term trend turning points; consolidation coupled with an upward trend represents a trading entry point. Each chart has its own wave pattern/trend. Currently, there is a gap due to the supply and short-term trend that has broken through the 53 medium-term resistance/support level. However, the minute-chart flow still indicates a remaining trend, so consider buying on a dip near 54.

💡 Investment Opinion

Cameco (CCJ) is one of the strongest names in the uranium sector, and

its breakout above $60 marks a potential transition into long-term trend acceleration.

This is not just a technical move—it’s a rhythm shift backed by macro themes and strong volume.

2-week expected return: +9.6% → $65.00 (Probability: 70%)

2-month expected return: +21.3% → $72.00 (Probability: 62%)

2-year return potential: +48.0% → $88.00 (Probability: 53%)

1. 📌 Summary

Cameco had been trapped in a $35–$50 box range for nearly two years.

Now, after a clean breakout with volume, it’s entering a new rhythm expansion wave.

The Bollinger Bands are expanding, and price has escaped a long-term range.

We are currently observing the early stage of a reacceleration pattern after the breakout.

2. 📈 RHYTHMIX Rhythm Analysis

🔹 Monthly Rhythm

- Broke out of a 2-year-long consolidation box

- Rising volume and wider Bollinger bands = higher institutional attention

- MACD is beginning to curve upwards with price strength above all moving averages

🔹 Weekly Rhythm

- Retest of core point ($52) confirmed support

- Clean breakout of dotted resistance ($60+)

- Two consecutive bullish candles post-breakout signal rhythm continuation

🔹 Daily Rhythm

- Short and mid-term moving averages are aligned and expanding upward

- Bollinger dotted top is widening → confirming breakout momentum

- Current zone $59.5–$60.5 is a natural consolidation area

- MACD histogram flipped positive + RSI is overbought = possible small pullback before second wave

📌 Core Point ($52): Critical level that converted resistance into support

📌 Dotted Resistance ($60–$63): Minor obstacle before full breakout zone

📌 Trap Watch: Any pullback and reversal from $57–$58 would be rhythmically bullish

3. 📊 Financial Overview

- Market Cap: $25.5B

- EPS: $0.57

- P/E Ratio: 141x

- Q1 Revenue: $549.6M (+24.4% YoY)

- Debt-to-Equity: 15.3% → solid and conservative

4. ⚠️ News & Risk Factors

- Global uranium demand is driving the narrative

- Despite Q1 earnings miss, revenue is solid and trend remains intact

- Short-term pullbacks may occur due to RSI overextension or news impact

- Watch for macro policy shifts or sudden commodity sentiment reversals

5. 🧠 Strategy Scenario (When, Why, How Much)

🎯 Entry Zone

$57.00 ~ $60.00 (Probability: 71%)

→ Strong support near breakout level

→ Bollinger and MA merge zones validate risk-controlled entry

🥅 Targets

- 1st Target: $65.00 (Probability: 70%)

- 2nd Target: $72.00 (Probability: 62%)

- Long-Term Target: $88.00 (Fibonacci extension 1.618 structure)

🛡️ Stop-Loss / Risk Management

$54.80 (Probability: 74%)

→ Below this level, structure weakens and rhythm invalidates

6. 🌈 Outlook

Cameco is rhythmically transitioning from a rebound phase to structural breakout territory.

If consolidation holds and volume doesn’t collapse, this breakout could sustain for weeks or even months.

“Quiet energy always precedes the surge.

The real breakout begins after the silence.”

7. 🧩 Member-Only Deep Dive

📌 Institutional Flow

- BlackRock, Vanguard have recently increased exposure

- Nuclear-themed ETFs (URA, NLR) show rising allocations toward CCJ

📌 Short Interest

- ~3.7% → not high, but may provide short-cover tailwind post-breakout

📌 Social & Trend Insights

- Reddit mentions for “Cameco” and “Uranium stocks” climbing

- Trending on X (Twitter): “$CCJ breakout” and “Uranium supercycle”