NASDAQ100 #NDXanalysis #GeniusAct #CBDC #Stablecoin #JPMorgan #USBonds #TechSector #BoxPattern

Hello, this is Top Trader Jinlog.

You can conveniently review the full chart-based report on our blog.

For continued market updates, feel free to subscribe or leave a comment.

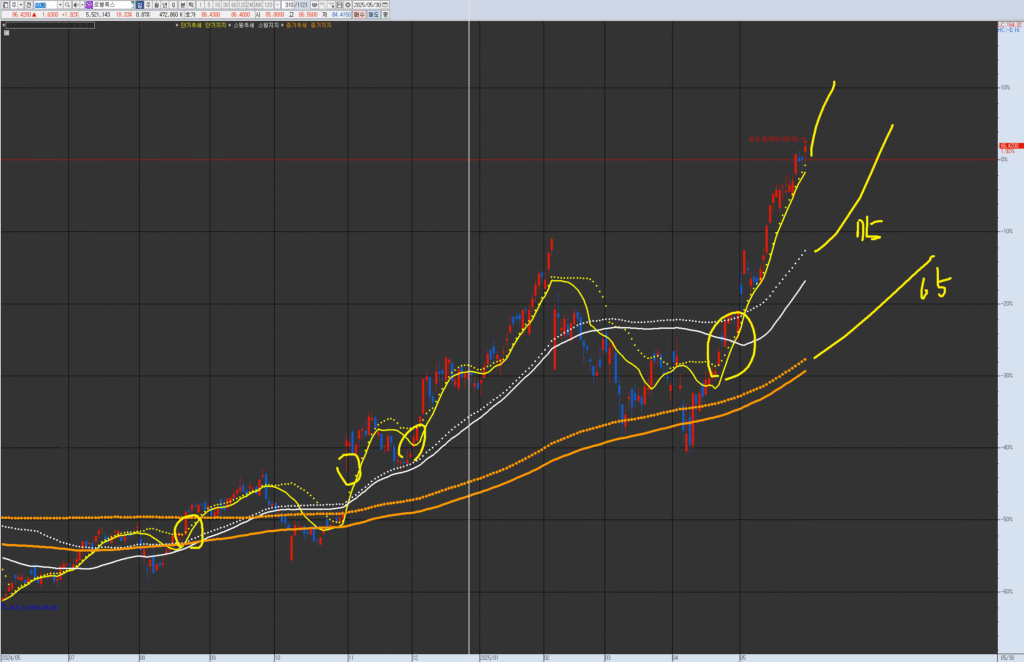

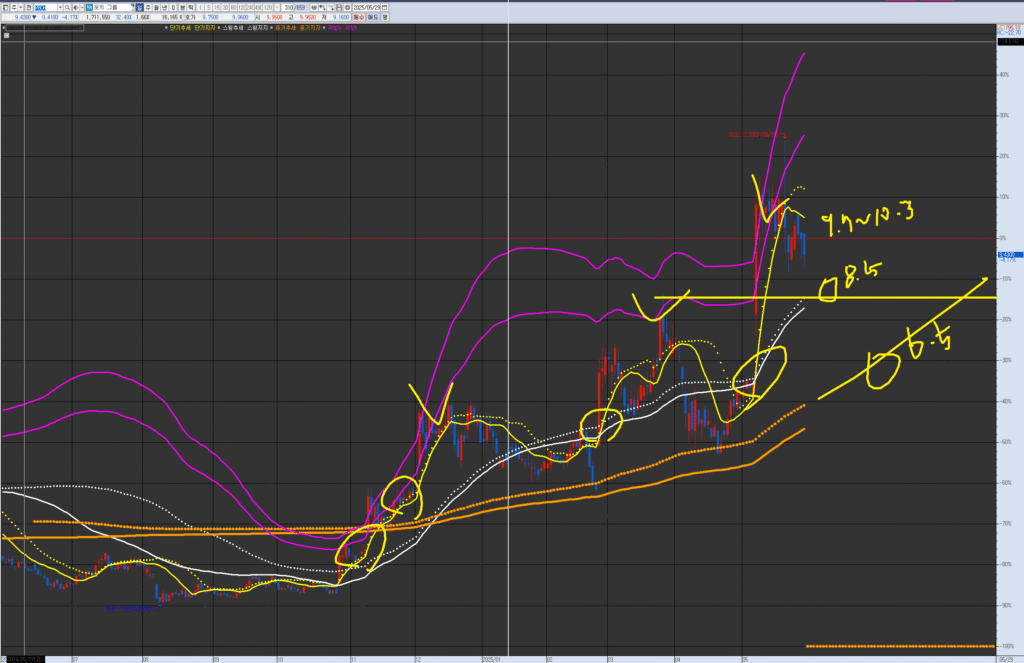

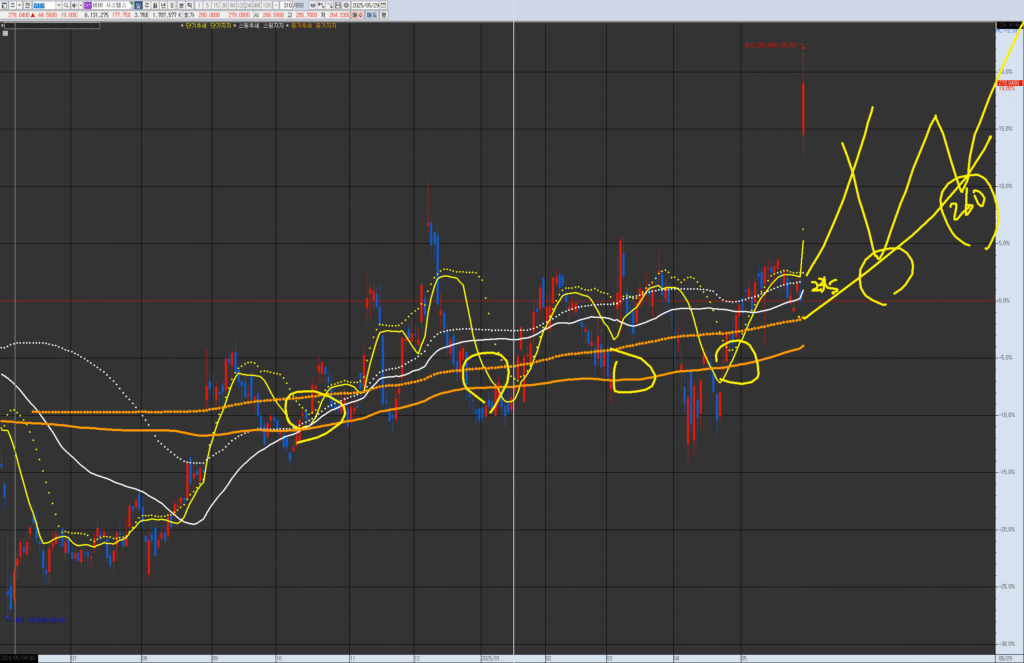

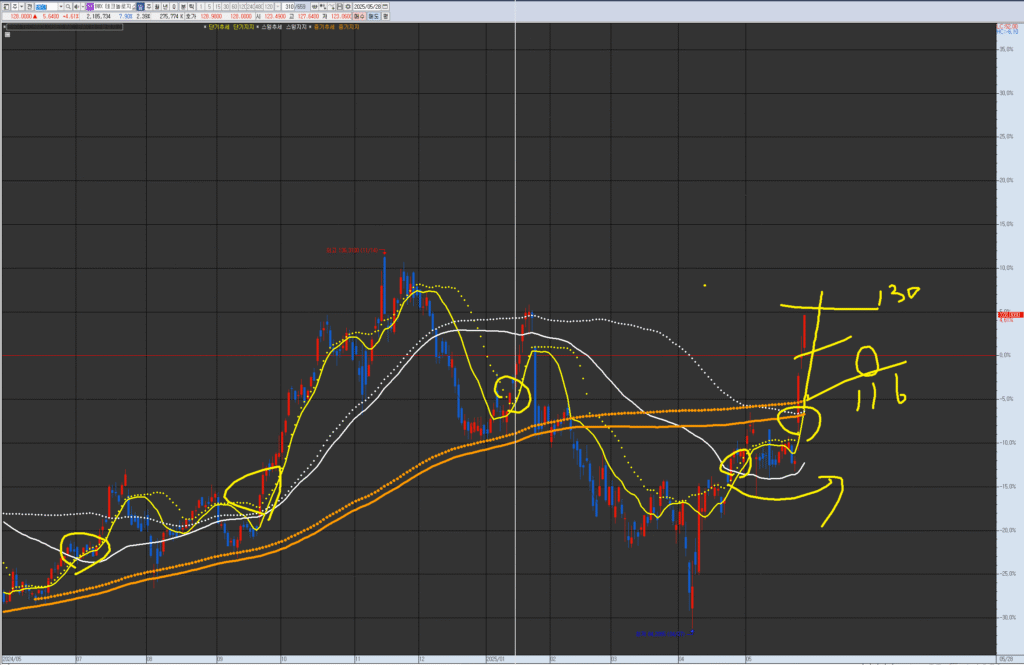

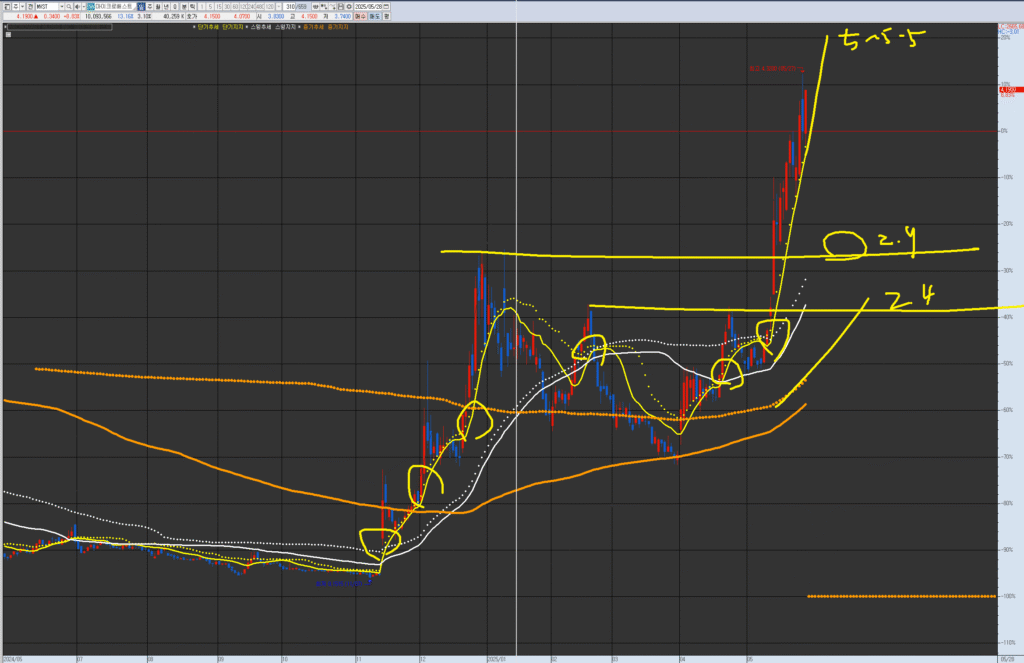

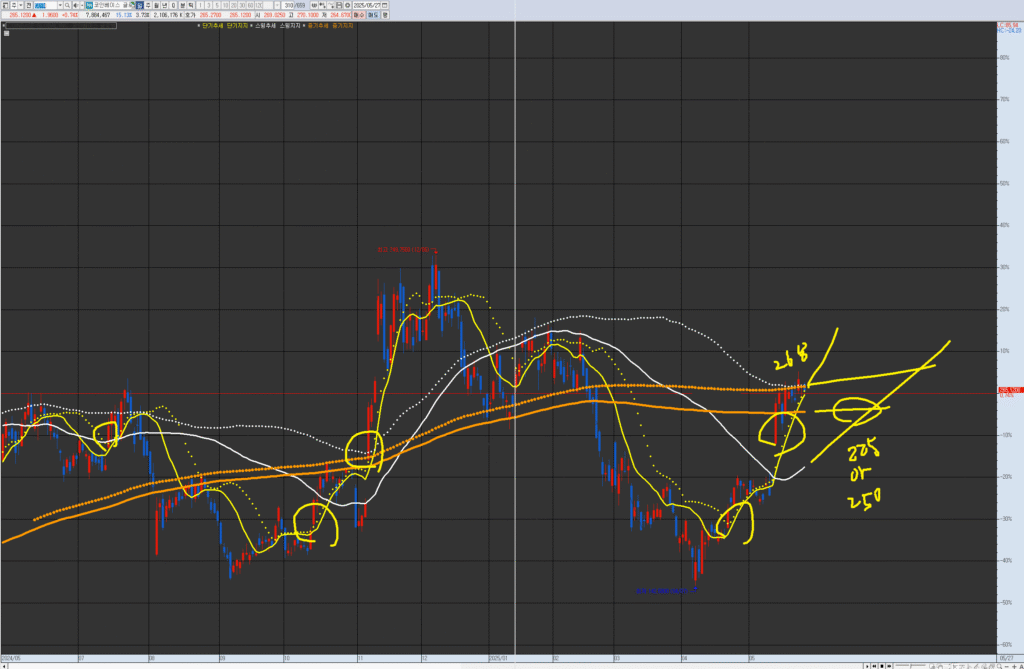

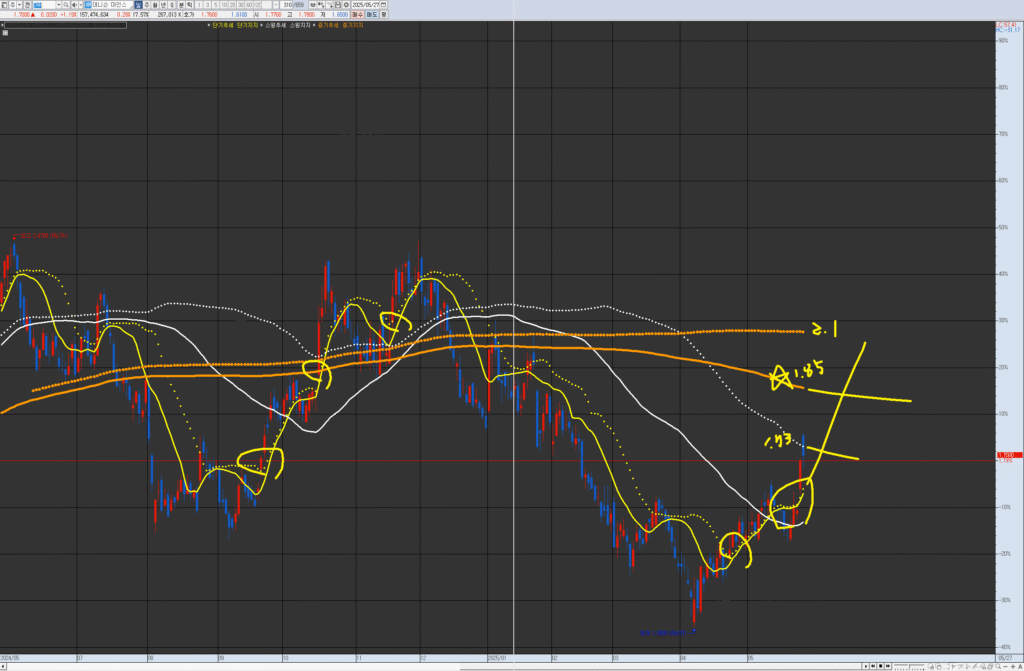

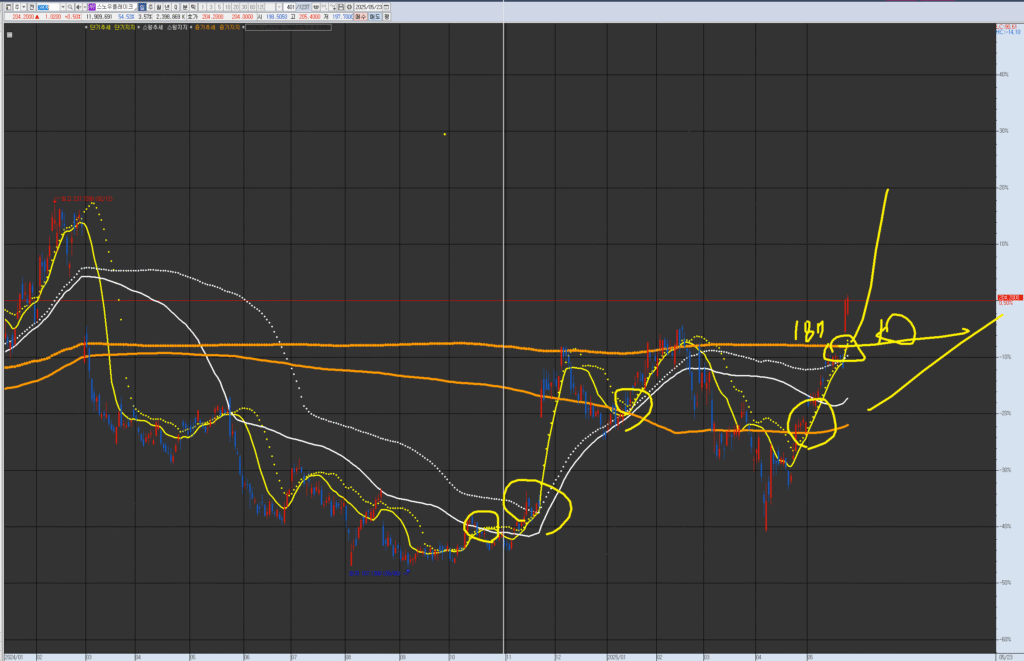

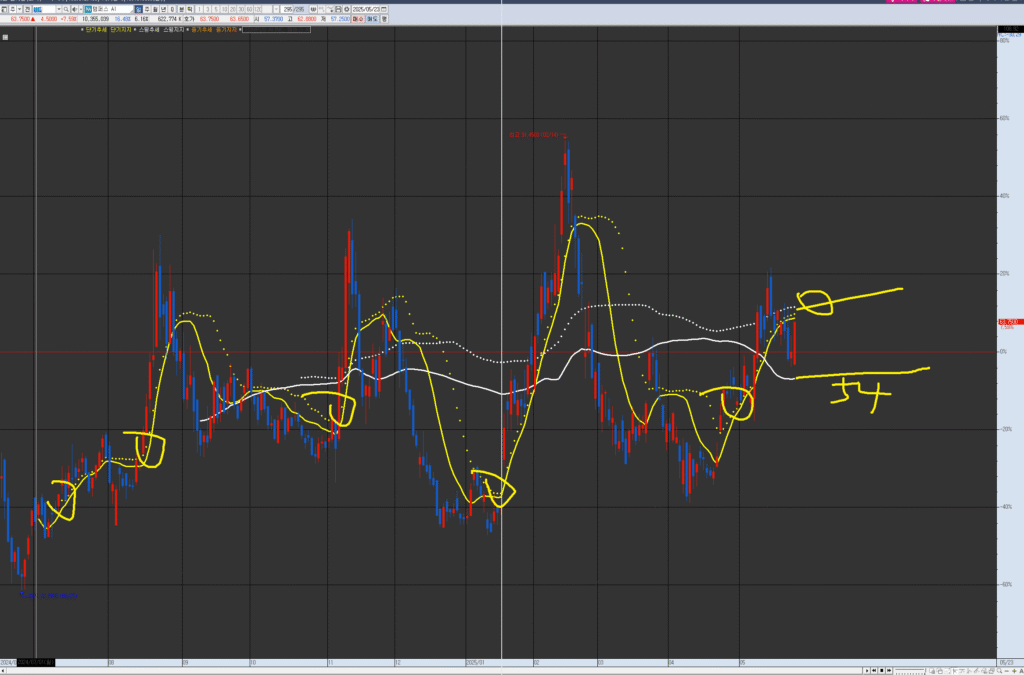

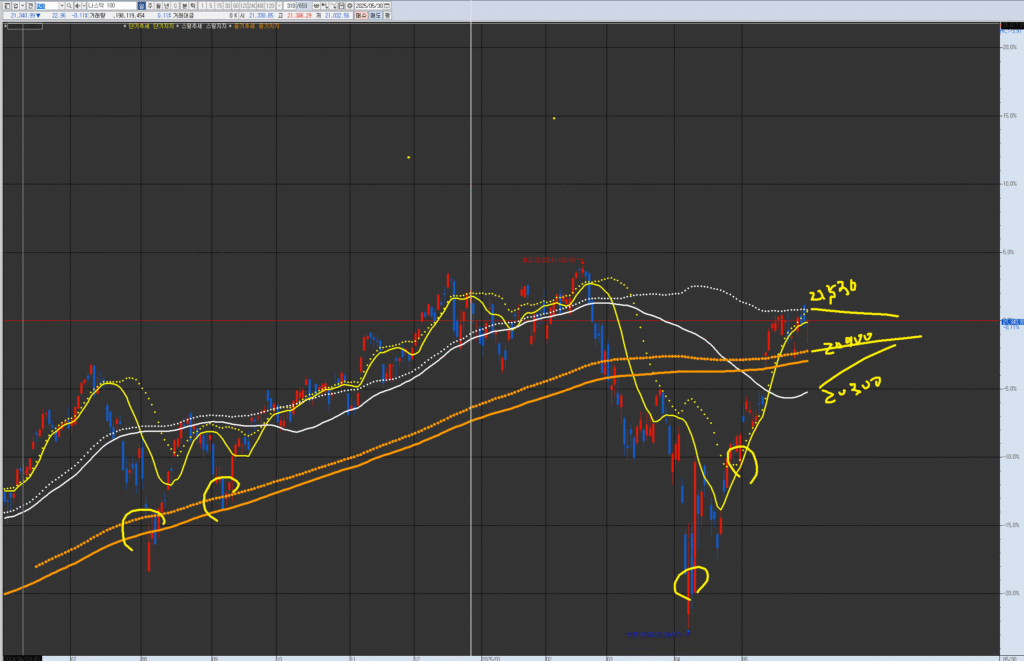

VPAR Chart Explanation This is the NASDAQ 100 chart. The circled areas in the past and present are potential short-term trend (yellow) consolidation and upward trend points. These points have a higher probability and potential return when they are near the swing line (white) or medium-term line (orange). Each chart has its own wave tension and trend. Currently, the key point of view is to check the re-ascending box pattern of the weekly wave (swing) between the short-term and medium-term resistance/supply levels.

Investment Outlook

NDX is currently positioned in a technical cooling phase with a time-based box consolidation, ahead of Q4’s anticipated policy event—the Genius Act.

According to rhythm structure, the likely scenario is: confirm support within the box → buy on dip → pre-policy breakout attempt.

→

- Short-term (2 weeks): Expected return range: -3% ~ +5% ($20,700 ~ $22,400), Probability: 60%

- Mid-term (2 months): Breakout to $22,800+ possible as policy expectations strengthen (Probability: 65%)

- Long-term (2 years): If digital payment systems expand and bond yield stabilizes, NDX may sustain a long-term uptrend (Probability: 70%)

→ Note: Monitor AI fatigue and political resistance risks

Summary

Market rallies rarely start suddenly.

The current range-bound and slow-moving behavior reflects energy being stored.

NDX is awaiting a pre-policy breakout, and as long as support holds, this could be a strategic buy-the-dip opportunity.

Key Variables

- The Genius Act, aimed at digital payment and surveillance infrastructure, is likely to go to vote in Q4 (October–December).

- The expansion of stablecoins (digitally pegged fiat assets) is increasing demand for U.S. Treasuries, pushing yields lower.

- Lower yields support tech equity performance, reinforcing NDX momentum.

- Within the tech sector, capital rotation toward AI and fintech remains visible.

Sector Snapshot (Key Rhythm Sectors Only)

- Technology (XLK / QQQ)

→ Testing box top resistance. Direction will likely be defined with policy anticipation momentum. - Semiconductors (SMH / SOXX)

→ AI flow remains but overbought cooling underway. Pullback expected until CPI in June. - Software (IGV)

→ High-valuation names continue under pressure. Support around mid-band remains critical. - Cloud & AI Infrastructure (CLOU / WCLD)

→ Long-term expectations intact, but short-term fatigue is visible. Hovering near lower supports. - Consumer Tech (XLY / AMZN)

→ Consumer weakness + high interest rates = continued underperformance. Lowest priority within tech subsectors.

Chart Alignment

- Monthly: Extended divergence with price nearing upper Bollinger band

- Weekly: Volume decline and trend weakening observed

- Daily: $21,500 resistance remains intact, while support at the rhythm midpoint is being tested

- 120-min: Box rhythm formation sustained near $21,080 midpoint

- 30-min: Downward wave patterns repeating

- 5-min: No clear direction—accumulation mode

Rhythm Trap

- Daily Midpoint: $21,200 remains key to holding pattern

- 120-min Rhythm Line (mid-band): $21,080

- Resistance at $21,500; support at $20,700

- Current price remains within a clear box range between rhythm midpoints and upper bands

- This setup is a textbook rhythm-based time correction pattern per RHYTHMIX Ver 7.0 standards

Scenario Paths

Bullish Scenario

- Entry Zone: $20,700–$21,100

- Conditions: Bond yields stay low, tech rotation resumes, policy anticipation rises

- Targets:

→ First: $21,800

→ Second: $22,400 (likely by August–September)

Bearish Scenario

- Breakdown Level: Below $20,600

- Conditions: Rising yields, MACD dead cross

- Targets:

→ First: $20,300

→ Second: $19,800

Strategic Plan

- Entry Zone: $20,700–$21,100 (Probability 66%)

- Targets:

→ $21,800 (Probability 65%)

→ $22,400 (Q4 policy pre-breakout, Probability 52%) - Stop-loss or Reversal: If price breaks below $20,600 (Probability 70%)

Outlook

With the Genius Act expected in 5–6 months, the market typically begins pricing in 3 months ahead.

Hence, the next 1 month may be box-bound with limited breakout potential.

Expect a clearer direction around August–September, as pre-policy optimism increases.

Until then, risk control and box support validation remain essential.

Deep-Dive Report

Bond Yield Trends

- 10-year U.S. Treasury yield has pulled back to 4.33%, creating a supportive environment for tech.

- Stablecoin-backed demand for bonds continues to weigh down yields.

- Yield volatility will remain the key to short-term tech rotations.

Institutional Flow

- ETFs in the tech sector continue to receive inflows.

- AI, semiconductors, and fintech show relative strength during dips.

Key News

- JP Morgan officially confirmed interest in issuing its own stablecoin.

- Genius Act may pass Senate by Q4.

- Political tension rising due to privacy surveillance concerns from opposition.

That concludes the NASDAQ100 (NDX) Market Report for May 31, 2025 – Ver 3.1.

If you found this helpful, don’t forget to subscribe or leave a comment.

The next critical trigger will likely be June CPI and shifts in interest rate tone.