eVTOL Commercialization Hopes vs. Rhythm in Convergence Phase?

JobyAviation #JOBY #eVTOL #UrbanAirMobility #FlyingTaxi #TrumpPolicyBoost #SaudiExpansion #ToyotaInvestment #VPARRhythmAnalysis #RHYTHMIXReport #TopTraderJinlog #USStocks #MobilityRevolution

Hello, this is TopTrader Jinlog.

You can check out this report with full charts on my blog.

For continuous analysis, feel free to subscribe or leave a comment.

If you want priority access to reports, please choose the priority processing option.

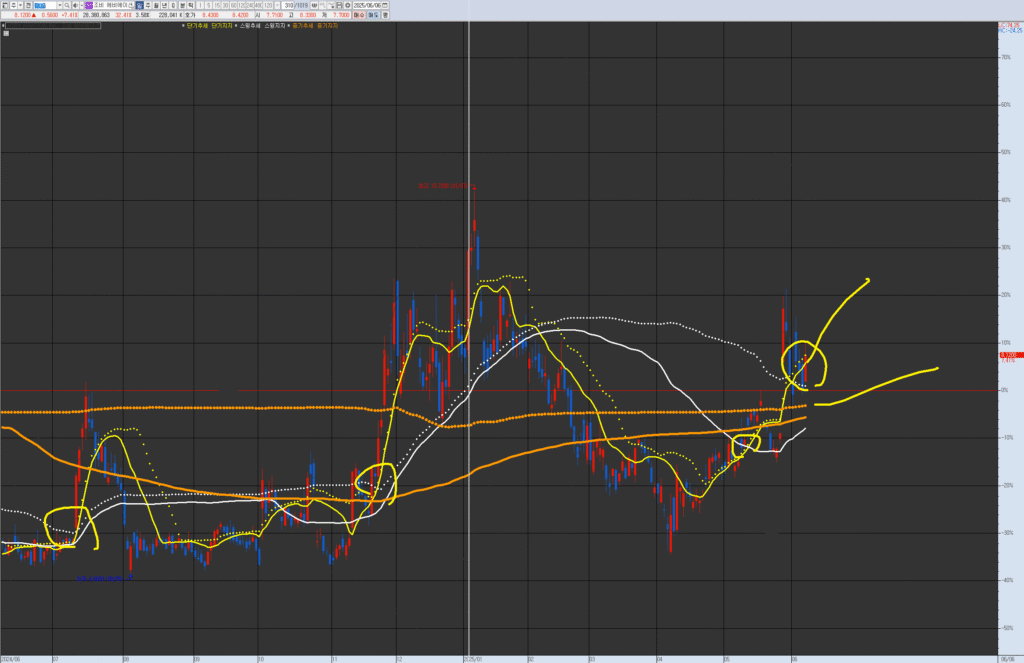

VPAR Chart Explanation This is Joby Aviation (JOBY.NYS), as requested for analysis. The circled areas in the past and present are potential short-term trend (yellow) consolidation and upward trend points. These points have a higher probability and potential return when they are near the swing line (white) or medium-term line (orange). Each chart has its own wave tension and trend. Currently, it is showing a trend of short-term/swing trend conversion above the medium-term (monthly wave) resistance/supply level. With the closing price above the short-term line, this stock is being considered for trading within a box range or entering for a swing trade, looking for a re-establishment on the short-term line or a return to a box pattern.

1️⃣ Investment Opinion

📌 Short-term wait & buy on dips → focus on rhythm convergence phase

📌 Medium-term upward trend potential remains valid

📌 Potential for repeated surge cycles driven by commercialization news/policy support

2-week expected return: +5.3% → $8.55 (probability 68%)

2-month expected return: +14.2% → $9.27 (probability 63%)

2-year long-term target: +67.9% → $13.63 (probability 52%)

2️⃣ Summary

Joby Aviation is gaining traction with recent MOU in Saudi Arabia, additional Toyota investment, and supportive Trump executive order.

Technically, monthly/weekly charts show rhythm convergence; daily/60min charts indicate an attempt to break out of short-term consolidation.

Avoid chasing highs — rather, employ a buy-on-dips strategy within the current range.

3️⃣ VPAR Rhythm Analysis

🌕 Monthly

- Resistance confirmed at ~$11 level → price returning to mid-range box.

- Rhythm moving from convergence → incomplete acceleration → back to convergence.

- Strong support around $6.80~7.00 range.

🟢 Weekly

- Acceleration → Trap → ongoing convergence & consolidation.

- Band Width narrowing → potential for re-expansion detected.

- Key support

$7.007.30; resistance$9.209.50.

🔵 Daily

- Recent sharp rise → overbought reset → now in box-range consolidation.

- MACD attempting to turn up from lows; RSI neutral — momentum needed.

- Box center

$8.008.40; breakout above $9.00 needed for strong uptrend.

🟣 60-Minute

- Trap confirmed → re-tested lows → attempting breakout post-convergence.

- Currently in mini-convergence; breakout could trigger swift upside move.

- Intraday focus on breakout above ~$8.20.

4️⃣ Financials

- Net loss continues: ~$608M (Q1 2025) → deep in red.

- Cash reserves: ~$812M → very strong short-term liquidity.

- Debt-free → zero leverage.

- Sustained investment required until commercialization phase is reached.

5️⃣ News & Risks Summary

- Saudi MOU with Abdul Latif Jameel → up to 200 eVTOL units, ~$1B potential value.

- Trump administration executive order boosting eVTOL sector — clear policy tailwind.

- Toyota $250M additional investment → strong support for manufacturing & certification.

- Key technical milestone: successful test flight of two eVTOLs simultaneously.

⚠️ Risks

- Potential delays in FAA certification process.

- Uncertainty over exact commercialization timeline.

- Potential for renewed overvaluation concerns.

6️⃣ Strategic Scenario

🎯 Entry

- Initiate buys at ~$7.90 ~ $8.15 zone.

- Consider adding on dips toward

$7.507.70.

🎯 Targets

- 1st target: $8.90 (probability 68%)

- 2nd target: $9.50 (probability 63%)

- Long-term target: $13.63 (probability 52%)

🚫 Stop-Loss

- Cut position if closing below $7.20.

7️⃣ Outlook

“When technology surpasses imagination, the market often anticipates the change first.”

Joby Aviation remains a visionary growth stock with both high potential and high risk.

From a RHYTHMIX perspective, it is now in a phase of stepwise consolidation rather than immediate breakout.

Policy momentum and industry tailwinds remain supportive — gradual medium-term accumulation is a valid approach.

8️⃣ Deep Dive

- Institutional flows: net buying detected over past 2 weeks → institutional interest gradually increasing.

- Short interest: 13.5% → relatively high → potential for squeeze remains.

- Social trends: eVTOL mentions rising for 4 consecutive weeks → increasing public interest.

Positive buzz particularly around Saudi-US-Japan (Toyota) collaboration.

Disclaimer

- This report is based on VPAR rhythm analysis and is for informational purposes only. Investment decisions are at your own risk.

- Updates will be provided if significant trend changes occur.