Rhythm in Convergence → Ready for Re-Acceleration?

Bitcoin #BTC #CryptoMarket #BitcoinETF #RHYTHMIXRhythmAnalysis #TopTraderJinlog #CryptoNews #BTCPriceOutlook #MarketAnalysis #BTCChart #ETFOutflows #CryptoTrends #TechnicalAnalysis #BTCBullishOutlook

Hello, this is TopTrader Jinlog.

You can check this report with full charts on my blog.

If you need continuous analysis, feel free to subscribe or comment.

For faster access to reports, please choose the priority processing option.

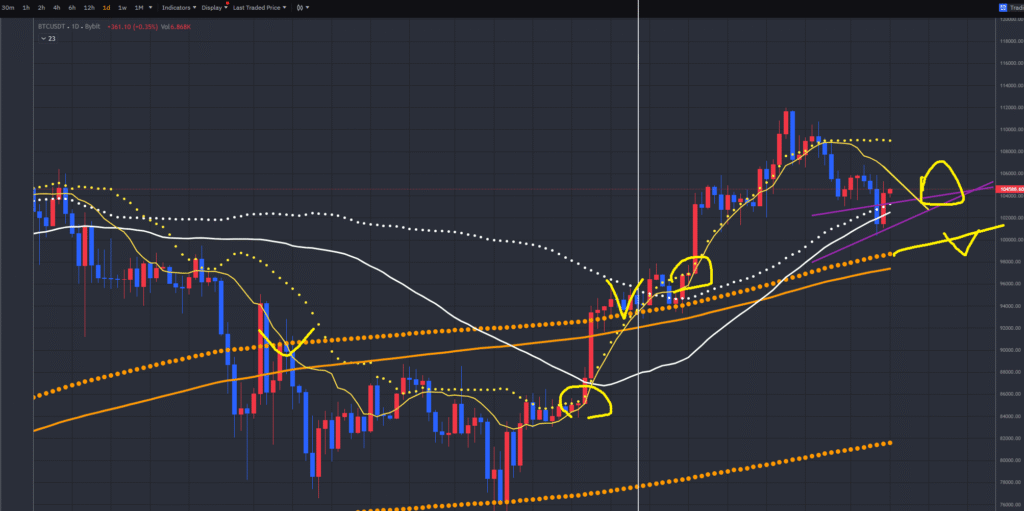

VPAR Chart Explanation This is the Bitcoin chart, as requested for analysis. The circled areas in the past and present are potential short-term trend (yellow) consolidation and upward trend points. These points have a higher probability and potential return when they are near the swing line (white) or medium-term line (orange). Each chart has its own wave tension and trend. Currently, it is above the medium-term (monthly wave) and swing (weekly wave) resistance/supply levels. It has been in a short-term downtrend for approximately 2 weeks. We are looking at the breakthrough and support trend of this short-term line to consider a swing entry point.

1️⃣ Investment Opinion

📌 Short-term wait & buy on dips → focus on rhythm convergence phase

📌 Medium-term upward trend potential remains valid

📌 Potential for repeated surge/dip cycles driven by policy/political news and ETF flows

2-week expected return: +4.8% → $109,580 (probability 66%)

2-month expected return: +11.2% → $116,320 (probability 61%)

2-year long-term target: +72.5% → $180,300 (probability 55%)

2️⃣ Summary

Bitcoin entered a corrective phase after reaching its all-time high.

Monthly and weekly charts show ongoing rhythm convergence, while daily and 120-min charts are attempting a short-term rebound after establishing a local bottom.

Despite increased volatility from ETF outflows and political issues, technically Bitcoin is regaining box center and positioning for potential re-acceleration.

3️⃣ VPAR Rhythm Analysis

🌕 Monthly

- Strong acceleration followed by first clear convergence phase.

- No Trap detected — maintaining position near box center.

- Rhythm indicates potential for re-acceleration in this phase.

🟢 Weekly

- BW (Band Width) convergence clearly underway; overbought pressure is easing.

- Key resistance at ~$111,800; box center support

$100,000105,000. - Weekly RSI / MACD trending back to neutral — watch for momentum recovery.

🔵 Daily

- Strong overbought conditions → Trap & sharp pullback → currently recovering

$102,000104,000. - Box support

$97,00099,000; breakout above ~$110,000 will open bullish path. - RSI rebounding from recent lows; MACD attempting to bottom.

🟣 120-Minute

- Local bottom confirmed at ~$102K → recovering toward box center.

- Breaking ~$105K may trigger quick move toward ~$108K.

- Rhythm recovering after recent Trap — short-term upside potential remains.

4️⃣ Financial Flow (Network / Fundamentals)

- Bitcoin hash rate at all-time highs — strong network security.

- Network fees stabilized after recent spikes.

- Active wallet count remains near highs — on-chain metrics still bullish.

- ETF flows: ~$400M net outflow → increasing short-term volatility.

5️⃣ News & Risks Summary

- Political issues → Trump vs. Musk comments triggered BTC sell-off (mk.co.kr)

- $400M outflow from US Bitcoin ETFs (economybloc.com)

- Weak US jobs data → rising Fed rate cut expectations → mid-term bullish catalyst for BTC (contents.premium.naver.com)

⚠️ Key Risks

- Prolonged ETF outflows could drive BTC below $100K.

- Political comments (Trump, etc.) could continue to increase volatility.

- Deeper correction possible toward

$97K99K if rhythm fails to regain upside momentum.

6️⃣ Strategic Scenario

🎯 Entry

- Accumulate

$102,000104,000 zone. - Add more if ~$100K fails — target

$97K99K zone.

🎯 Targets

- 1st target: $109,580 (probability 66%)

- 2nd target: $116,320 (probability 61%)

- Long-term target: $180,300 (probability 55%)

🚫 Stop-Loss

- Close below $96,500 triggers stop-loss.

7️⃣ Outlook

“The market feeds on uncertainty — the key is to catch the moment when rhythm starts to pulse again.”

Bitcoin is now in its first significant correction since reaching its all-time high.

Technically, it still holds strong potential for re-acceleration after completing this convergence phase.

While short-term risks stem from ETF outflows and political comments, medium-term bullish cycle remains intact.

8️⃣ Deep Dive

- Institutional flows: ETF outflows observed — monitoring for signs of reinflows.

- Short interest (funding rates): shifting from neutral to slightly long-biased.

- Social trends: BTC-related mentions surged recently but now stabilizing — further interest likely if $100K holds.