#BWXT #NuclearEnergy #DefenseStocks #TechnicalAnalysis #RHYTHMIXReport #CleanTech #SwingTrading #StockBreakout #InstitutionalFlow #USMarket

Hello, this is Top Trader Jinlog.

You can view the report conveniently with charts on the blog.

For ongoing market analysis, feel free to subscribe or leave a comment.

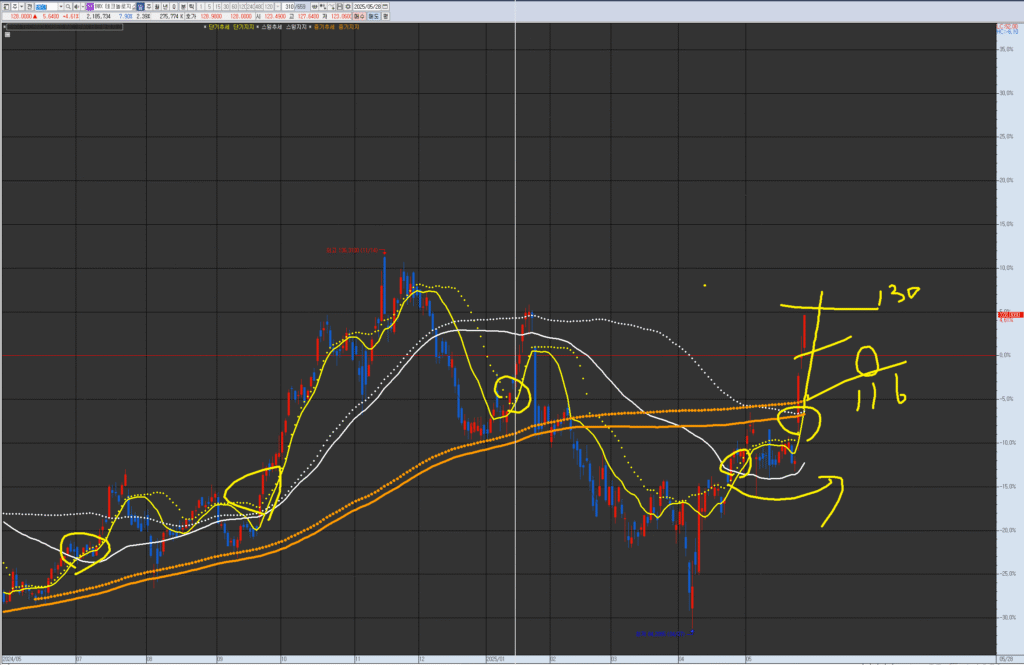

VPAR Chart Explanation This is BWX Technologies (BWXT), as requested for analysis. The circled areas in the past and present are potential short-term trend (yellow) consolidation and upward trend points. These points have a higher probability and potential return when they are near the swing line (white) or medium-term line (orange). Each chart has its own wave tension and trend. Currently, it has re-entered the medium-term line after breaking below it and is in a short-term trend. If it holds support at 116, we can see the possibility of an upward-sloping box pattern within the medium-term (monthly wave) trend again. There is currently a gap with the short-term line. Consider trading for further upside during a correction close to the short-term line above 130, or if it breaks below the short-term line, consider it a potential buying point on a dip at 116.

💡 Investment Opinion

BWXT is benefiting from a structural shift in U.S. energy policy and steady financials,

positioning itself for continued upside momentum.

- 2-week expected return: +6.7% → $136.60 (Probability 68%)

- 2-month expected return: +14.8% → $147.00 (Probability 62%)

- 2-year long-term target: +41.4% → $181.00 (Probability 58%)

1. Summary

- BWXT is rallying on expectations tied to U.S. nuclear infrastructure initiatives.

- The current overbought condition could bring a short-term cooldown.

- Medium-term rhythm remains intact, and structure is bullish.

2. 📊 V.P.A.R Interpretation (Visual Phase Alignment Rhythm)

- 🔵 Monthly: Bollinger top breakout, followed by cooling period

- 🟡 Weekly: Post-3-wave rally, in consolidation; breakout retest possible

- 🟠 Daily: Trading between $120–$128 consolidation zone

- 🔴 120min: Still aligned in short-term uptrend; overextension likely to ease

Conclusion: Overbought short-term, but rhythm remains bullish

→ Re-entry possible on dip / $125 key zone to watch

3. 📈 RHYTHMIX Rhythm Analysis

⏳ Monthly

- Strong top expansion in Bollinger Bands

- RSI in overbought region; $130+ may trigger soft pullback

- Trendline support in $113–$117 zone

📉 Weekly

- Momentum high; MACD topping

- Positive alignment of trend lines

- Watch for pullback if $125 is broken / resistance at $138.2

⏱ Daily

- Centerline holding at $124.5–$126.5

- Volume thinning in consolidation

- Still respecting structure — reacceleration possible on breakout

🕐 120-Minute

- Short-term trend intact with slight MACD reset

- Narrowing consolidation may lead to breakout

- Price above $127 could trigger short-term rally extension

4. 💰 Financial Overview

- Q1 2025 Revenue: $682.3M (+13% YoY)

- Net Income: $75.5M

- Adjusted EBITDA: $129.8M

- EPS: $0.91 (beat expectations)

- 2025 Guidance: EPS range of $3.40–$3.55 maintained

5. ⚠️ News & Risk Summary

- U.S. executive order boosts nuclear infrastructure momentum

- Acquisition of Kinectrics Inc. to enhance nuclear services & radiopharmaceutical reach

- Nuclear regulatory risks remain

- High price perception may prompt short-term profit-taking

6. 🧠 Strategy Scenario

🎯 Entry Zone

$124.00 ~ $127.00

→ Strong structural support + rhythm consolidation zone (Probability 69%)

🎯 Targets

- Target 1: $136.60 (Probability 68%)

- Target 2: $147.00 (Probability 62%)

- Long-Term: $181.00 (Probability 58%) – supported by structural trend + policy flows

🚫 Stop-Loss or Response

- Drop below $121.00 may signal structural weakness

→ If accompanied by falling volume, initiate defensive exit (Probability 76%)

7. 🌈 Outlook (Emotional Rhythm Commentary)

Policy provides the direction.

Rhythm turns that direction into conviction.

BWXT may be taking a short breath,

but it’s aligned with a much larger trend—nuclear renaissance.

8. 🧩 Deep Dive Report (Member-Only)

📌 Institutional Flow

- BlackRock, State Street showing net buys

- $100M+ net institutional inflow in past 4 weeks

📌 AI Forecasting

- Danelfin AI Score: 6.5/10 (Buy Bias)

- 3-month outperformance probability: 41.2%

📌 Industry Trends

- U.S. nuclear projects expanding in energy + defense sectors

- Growing importance of space nuclear propulsion and microreactors

📌 Analyst Target Price

- Average price target: $145–$152

- New high-end analyst target raised to $160