#Bitcoin #BTC #Cryptocurrency #RhythmAnalysis #SwingTrading #TrapRelease #DigitalGold #OnChainMetrics #CryptoStrategy #RHYTHMIX #MarketRhythms #TechnicalAnalysis #CryptoInvesting #TraderMindset #FinancialInsights

Hello, this is JinLog, your top trader and market analyst.

This video includes both technical report analysis and in-depth scenario discussion.

You can also find a blog-style summary of this report for quick reference.

4. Summary

After trading inside a box range for the past month without major deviation, Bitcoin has cleared both short-term and swing traps and shows signs of a renewed swing wave.

- Short-term trend maintained with rhythm expansion → Entry at $107,700

- Swing trend maintained with stable rhythm → Entry at $106,000

- Mid-term trend maintained with rhythm expansion → Entry at $97,150

- Current price: $109,360

5. Investment Outlook

- Short-term: Monitor for consolidation above $107,700; potential rally toward $118,000

- Swing: Rhythm stability around $106,000 suggests robust support; target $118,000

- Mid-term: Expansion from $97,150 supports a run to $136,000

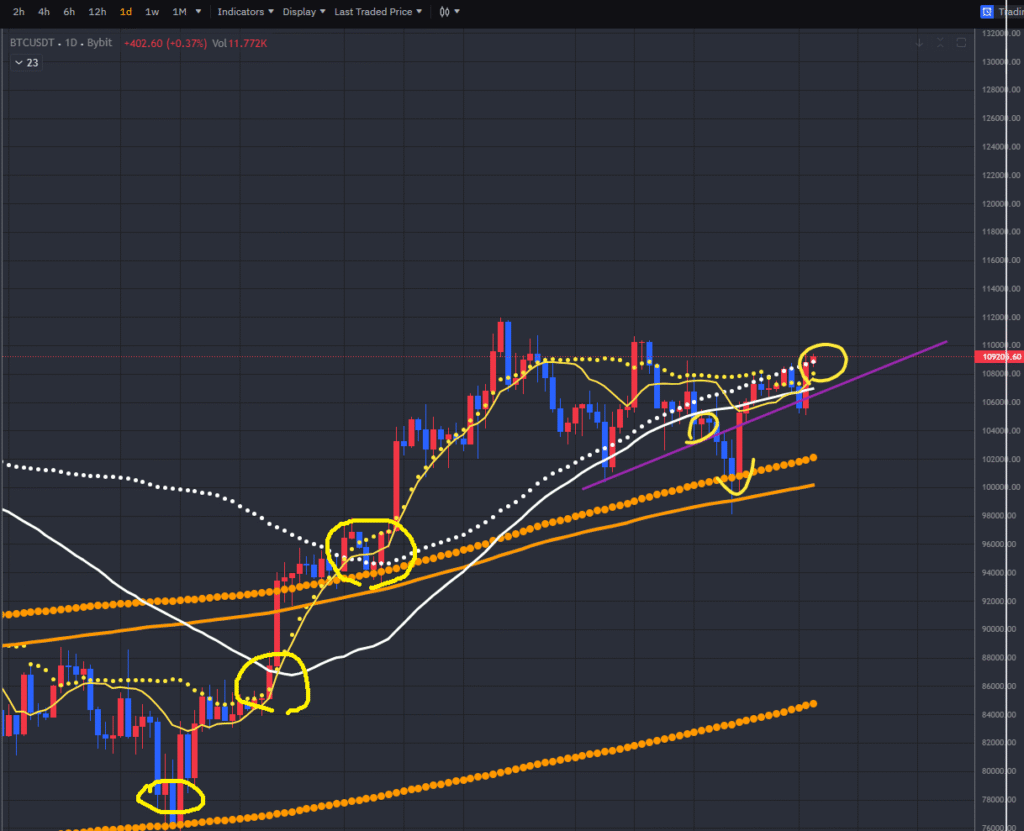

6. Chart Commentary

“This is the Bitcoin chart you requested.

Circled regions highlight trap-release points where technical criteria converged.

Entries near those swing-trap clearances historically offer higher probability setups.

Always check rhythm flows and wave structures on each timeframe.”

7. Rhythm Analysis

- Short-term Rhythm: Expansion phase confirmed after trap release; momentum building

- Swing Rhythm: Stabilized contraction with clear support at $106,000; ready for expansion

- Mid-term Rhythm: Expansion resuming above key pivot at $97,150; signals longer-term uptrend continuity

8. Financial Overview

- Market Cap: ~$1.8 trillion, representing over 50% dominance in total crypto market

- On-Chain Dynamics: Long-term holders continue to absorb profit-taking, maintaining upward pressure

- ETF & Institutional Flows: Ongoing approvals and large-scale corporate allocations underpin institutional confidence

9. News / Risks / Events

- ETF Developments: Continued SEC reviews and potential approvals fueling optimism

- Regulatory Watch: Global CBDC initiatives and U.S. policy signals creating both tailwinds and headwinds

- Mining Trends: Shift toward renewable energy mining easing environmental concerns

- Macroeconomic: Dollar dynamics and Fed communications remain key catalysts

10. Strategy Scenarios

✅ Short-Term Buy Strategy

- Entry Zone: $107,700

- Conditions: Rhythm expansion + short-term trend support + volume confirmation

✅ Swing Buy Strategy

- Entry Zone: $106,000

- Conditions: Rhythm stabilization + swing-trap clearance + macro catalysts aligned

✅ Mid-Term Buy Strategy

- Entry Zone: $97,150

- Conditions: Mid-term rhythm expansion + institutional inflow confirmation

11. Elliott Wave Analysis

- Current Position: Likely Wave 3 initiation after completing Wave 2 correction around $97,150

- Scenario: Wave 3 targeting $136,000; interim Wave 2 support at $106,000

- Wave Interpretation:

- Wave 1 Peak: $118,000

- Wave 2 Base: $97,150

- Wave 3 Projection: $136,000

12. Community Sentiment

| Platform | Keywords | Sentiment | Summary |

|---|---|---|---|

| #Bitcoin #BTC | Bullish | “Trap cleared—time to ride the next wave” | |

| StockTwits | $BTC #Rhythm | Optimistic | “Strong support at 106k, target 118k” |

| #Crypto #ElliottWave | Mixed→Bullish | “Wave 3 could be massive, watch 97k pivot” |

13. Forecast & Risk Summary

- Forecast: Breakout confirmed; potential run to $118k short-term and $136k mid-term

- Risks: Regulatory reversals, profit-taking by long-term holders, sudden macro shocks

- Flow Factors: ETF approvals, institutional treasury allocations, on-chain accumulation

- Technical Note: Key levels at $107.7k, $106k, and $97.15k

14. Advanced Insights

- Institutional Flow: High-net-worth allocations increasing via OTC desks

- Social Metrics: Bullish engagement up 45% month-over-month on crypto forums

- On-Chain Indicators: Active addresses and hashrate trending higher

- AI-Driven Signals: Algorithmic sentiment turning positive since trap release

15. Disclaimer

This report is based on the VPAR Rhythm Analysis System.

All rhythm flows, wave counts, and scenario setups are for informational purposes only.

Investment decisions should be made at the investor’s own discretion and risk.