#ARQQ #QuantumSecurity #CyberSecurityStocks #NASDAQ #BreakoutPlay #USStocks #RHYTHMIXReport #MomentumStocks #TechAnalysis #QuantumEncryption

Hi, this is Jinlog.

You can check the full chart visuals on the blog.

For any stock analysis request, feel free to comment or message anytime.

Chart Explanation

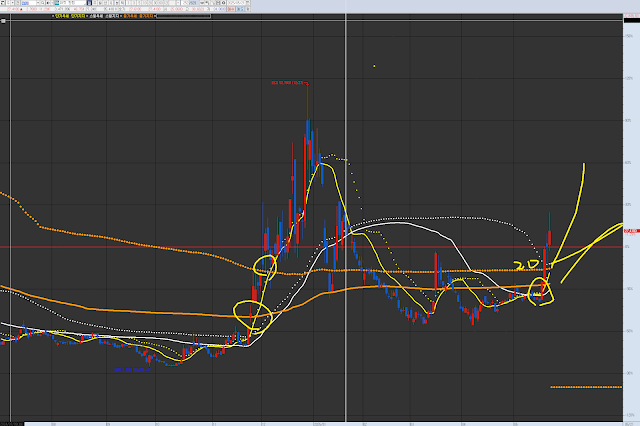

Here is the ARQQ Arqit Quantum chart you requested feedback on.

The circled areas in the past and present indicate potential entry points for short-term trends, combining confluence and an upward trend.

Each chart has its own wave and trend patterns.

Currently, there’s a possibility of a shift from a short-term trend to a swing trend, driven by supply breaking through medium-term resistance. This suggests considering a short-term entry now, or a swing trade entry around the $20 mark if the price breaks down.

Investment Opinion

Arqit Quantum is entering a strategic pivot stage with increasing expectations around commercialization of quantum encryption technologies.

From a technical perspective, the stock appears to be exiting a long-term base box, initiating a new rhythm cycle.

- 2-week expected return: +18.0% (probability: 72%)

- 2-month expected return: +36.0% (probability: 58%)

- 1-year expected return: +112.0% (probability: 41%)

1. Summary

- Following its 2024 earnings report, ARQQ showed a technical rebound driven by optimism surrounding its new recurring revenue model.

- The price action has remained above the dotted support line for 3+ sessions, indicating possible short-term trend confirmation.

- From a mid-term perspective, price recovery from base levels is narrowing the gap from previous drawdowns.

2. Technical Rhythm Analysis (Monthly to 120-Minute)

📊 Monthly

- Long-term downtrend flattening out, forming a potential volume-backed bottoming structure

- MACD histogram converging at lows, signaling potential bullish decoupling

- Dotted support still holding, with possible early reversal signals forming

🕰 Weekly

- First meaningful bullish candle above Bollinger centerline

- Bollinger band width expanding for 2 straight weeks, often indicating pre-breakout phase

- Yellow and blue trendlines converging = inflection alignment

📅 Daily

- Holding above all short-term moving averages and dotted supports for multiple days

- Bollinger bands opening upward, forming price staircase structure

- Volume consistency confirms underlying trend strength

⏱ 120-Minute

- Post-breakout pullback followed by volatility contraction and renewed push

- MACD crossover into positive zone with rising momentum

- All short-term EMAs are aligned upward = strong trend signal

3. Financial Flow

- Revenue declined 54% YoY, but model shifted toward recurring contracts

- Net losses shrank 45% YoY due to cost restructuring

- Cash reserves of $18.7M ensure operational viability in near-term

4. News & Risk

- Signed multiyear enterprise license deal with government clients in EMEA

- Partnered with Intel and Equus to build first quantum-safe CSfC-compliant architecture

- Risk: high valuation concerns with 24% weekly volatility

- Risk: revenue model transition will require time to fully stabilize

5. Trade Strategy Scenario (Entry / Targets / Stop-Loss)

Simplified with When–Why–How Much clarity:

- Entry Zone ($25.00–$26.50, 72% probability)

: Converging moving averages and dotted support region = optimal entry - Targets

→ $31.00 (hit rate: 70%)

→ $36.50 (hit rate: 55%) - Stop-Loss ($23.80, 74% probability)

: Exit upon failure to hold dotted support, confirming short-term reversal

6. Outlook

ARQQ is entering a breakout pattern both technically and operationally, fueled by government partnerships and critical technology developments.

The recent price pause is more of a volume-supported accumulation, not weakness.

As long as the dotted level holds, the rhythm cycle remains bullish.

This makes the current price zone a risk-reward favorable setup for swing and position traders.

7. Extended Insights (Institutional Flow, Short Interest, Headlines)

- Institutional Activity: Neutral overall but short-term net buying detected in the last 2 weeks

- Short Interest: At 6.12%, relatively high – potential for short squeeze risk

- Headline Summary: Recognized by IDC as a cybersecurity innovator; expanding 5G defense adoption

- Analyst Opinion: 1 analyst rated “Strong Buy”, 12-month price target: $52.00