NASDAQ100 #NDX #GeniusBill #TechRally #AIStocks #GeopoliticalRisks #SwingTrading #ElliottWave #RhythmAnalysis #Volatility #MacroControl #MarketStructure #USStockMarket #23000Breakout #StockForecast

Hello, this is JinLog, your top trader and market analyst.

This video includes both technical analysis and scenario-based strategy discussions.

Blog-format summary is also available for quick reference.

“Following the post regarding the one-month consolidation after the GENIUS Act announcement.”

After the Genius Bill announcement, NDX entered a 1-month box range.

With rhythm expansion now underway, key technical zones are being revisited.

War-related headlines appear more like macro control narratives than actual market disruptors,

suggesting a calculated transition into a full swing and mid-term expansion phase.

- Short-term trend: Maintained → Rhythm expansion → Entry: 22,000

- Swing trend: Maintained → Rhythm expansion → Entry: 21,650

- Mid-term trend: Maintained → Rhythm expansion → Entry: 21,500

- Current Price: 22,534

5. Investment Outlook

- Short-term: Rhythm breakout likely → 23,000 in sight

- Swing: Solid uptrend → Target 24,900

- Mid-term: Long-range continuation to 26,270 expected

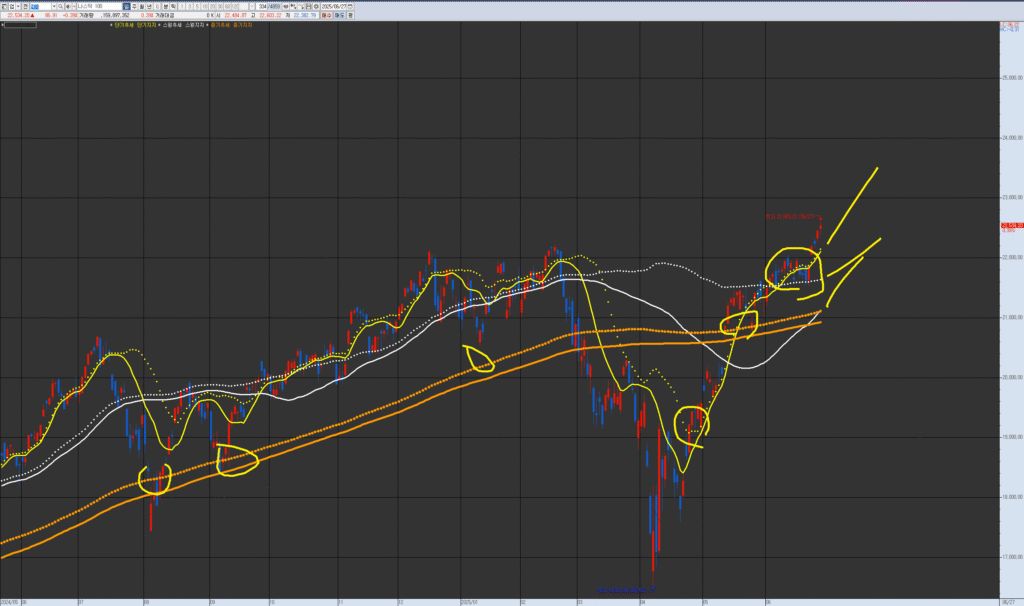

6. Chart Commentary

“This is the chart for the NASDAQ 100.

Highlighted zones mark key merge points in short-term trends with bullish structure.

The closer we are to swing or mid-term trendlines, the higher the probability and yield.

Always monitor rhythm and wave formations on each chart.”

7. Rhythm Analysis

- Short-term Rhythm: Expanding → Confirmed if 22,000 holds

- Swing Rhythm: Entry at 21,650 shows upside potential in expanded structure

- Mid-term Rhythm: Expansion phase activated → momentum buildup from 21,500

8. Financial Overview

(Index-based report – individual earnings not detailed)

- Focused on composite earnings trend for tech/AI-heavy constituents

- Key weight: NVDA, AMD, MSFT, GOOG, AAPL → guiding rhythm flow

9. News / Risks / Events

- Genius Bill triggered a box pattern over 4 weeks

- Geopolitical conflicts serve as justifications for liquidity control

- Death and injuries seen as tokens in macro chessboard by institutional players

- AI optimism + Fed’s pause stance on rates = bullish drivers

10. Strategy Scenarios

✅ Short-Term Strategy

- Entry Zone: 22,000

- Condition: Rhythm expansion + short-term trendline support + momentum confirmation

✅ Swing Strategy

- Entry Zone: 21,650

- Condition: Expanded rhythm + trend confirmation + 2nd-stage trap cleared

✅ Mid-Term Strategy

- Entry Zone: 21,500

- Condition: Long-term rhythm breakout + earnings tailwind + structural wave support

11. Elliott Wave Analysis

- Current Phase: Wave 2 complete → Wave 3 onset likely

- Scenario: Accumulation between 21,500 ~ 22,000

- Wave Targets:

- Wave 1 Peak: 23,000

- Wave 2 Base: 21,500

- Wave 3 Target: 26,270

12. Community Sentiment

| Platform | Keywords | Sentiment | Summary |

|---|---|---|---|

| #NDX, #AIstocks | Neutral → Bullish | “AI still hot, but overvaluation mentioned” | |

| StockTwits | #NDX100, #GeniusBill | Rising Interest | “Expecting strong move after Genius Bill” |

| #TechRally, #MacroControl | Mixed | “Even war seen as a market control tool” |

13. Forecast & Risk Summary

- Forecast: Box breakout likely, full swing wave beginning

- Risks: Earnings disappointments, macro event fatigue, no fresh narratives

- Flow Factors: Continued AI fund inflow from institutions

- Technical Note: Rhythm expansion = signal for ongoing upward trend

14. Advanced Insights

- Institutional flow: Confirmed via leveraged ETFs (e.g., TQQQ, QQQ)

- Social mentions: +41% increase month-over-month

- Short interest: Being covered in low-volume pops

- AI flow: Heavily concentrated in mega-cap tech → mid-tier AI plateau

15. Disclaimer

This report is based on the VPAR Rhythm Analysis System.

All rhythm flows, wave interpretations, and scenario setups are for educational and strategic reference.

Investment decisions must be made at the investor’s sole discretion and risk.