GEAerospace #GE #GEstock #USstocks #AerospaceDefense #ParisAirShow #MACDflow #TrapRecovery #RHYTHMIXanalysis #TopTraderGeneLog #VPARanalysis #TechnicalSwing #StockForecast #SwingEntry

Hi, this is Gene Log, your top trader.

This RHYTHMIX Report is followed by an audio-based talk show for easier understanding.

If you prefer reading, check out our blog post version.

To better grasp market timing and direction, refer to our live index commentary.

For ongoing coverage, consider subscribing or leaving a comment.

Need faster insights? Select the priority report option.

1️⃣ Summary

GE Aerospace stock is currently in a mid-term rhythm wave, bouncing around the Swing zone after a recent short-term trendline break.

Heavy selling pressure is visible at the swing support cluster, but if MACD convergence and Trap recovery conditions align, a short-term bounce scenario becomes likely.

2️⃣ Investment Targets

2-week price target: +4.2% → $248.75 (Probability: 65%)

2-month price target: +10.7% → $264.30 (Probability: 60%)

Long-term price target: +20.2% → $287.00 (Probability: 55%)

📌 Analyst Outlook:

GE is forming a natural squeeze structure near its swing support band.

If trap recovery and MACD convergence signals emerge, a sharp rebound may be triggered.

However, failure to hold the swing level may lead to a mid-term retracement scenario.

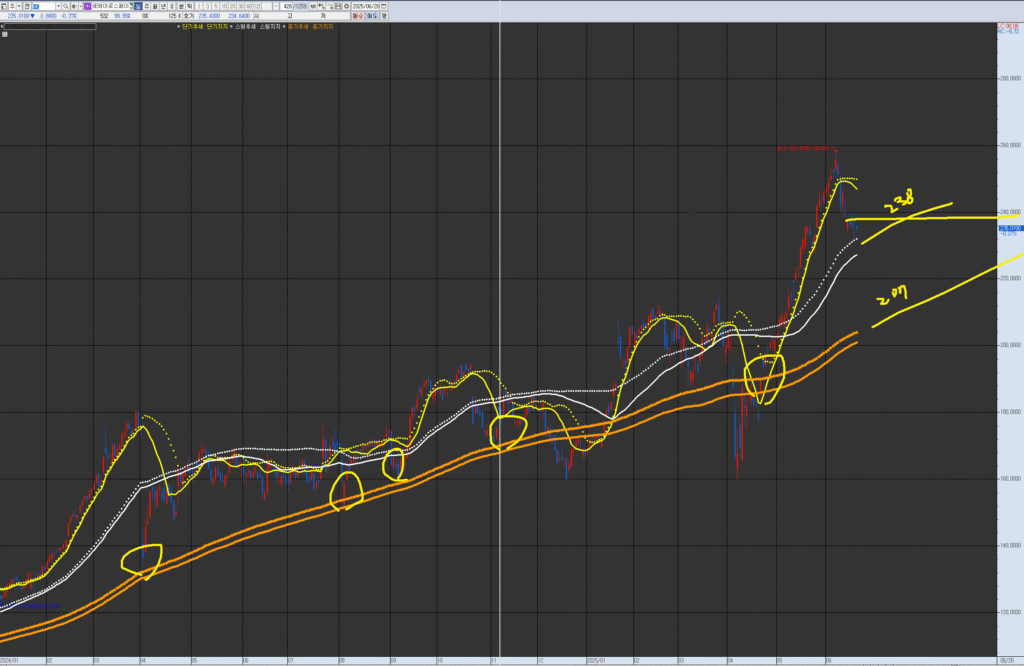

🔖 VPAR Chart Insight (Standard Text)

Here’s the requested VPAR chart for GE Aerospace.

Highlighted circles mark historical confluences of short-term rhythm waves and rising trend junctions.

When near Swing lines (dotted white) or Mid-term support (solid yellow), success rate improves dramatically.

Each wave has its own tension and rhythm – refer to this report for your next entry scenario.

3️⃣ VPAR Rhythm Analysis

- Current structure: Mid-term rhythm extension followed by retracement toward swing support

- Short-term support broken, testing Swing support (dotted white) with high-volume rejection

- Rhythm wave is cycling through “Compression → Recovery → Expansion”

- MACD trend:

- Short-term: Converging with signs of shift

- Swing-term: Still in support mode, not yet reversed

- If rhythm recovery overlaps with MACD signal shift, a high-probability expansion phase could follow

4️⃣ Financial Overview

- Q1 2025 results:

- Revenue: $9.94B (+11%)

- Net Profit: $2.2B

- Operating Margin: 23.8%

- Free Cash Flow: $1.3B

- Strong backlog of $170B in aerospace and defense orders

- Major investments in LEAP engine reliability and future RISE engine (2030s)

5️⃣ News & Risk Summary

- Boeing 787 crash (with GE engine) triggered temporary selloff (~4%)

→ GE confirmed no core fault; limited long-term impact - Anticipation building toward Paris Air Show – AI-integrated tools and new engine models in spotlight

- $500M tariff impact was neutralized by operational efficiency + policy strategy

- Post-spinoff performance: 2024 TSR +65%, stronger R&D output

6️⃣ Strategic Scenario (Entry / Targets / Stop-Loss)

✅ Short-Term Entry Zone

- Condition: Near short-term trendline + support confluence

- If price is near range: Watch for trap recovery + MACD convergence → bounce expected

- Entry range: $234.20 ~ $236.50

- Expected box period: ~5 sessions (trap resolution)

- Reason: Trap resolution + MACD flow convergence

- Target tie-in: “Linked to 2-week target of $248.75”

✅ Swing-Term Entry Zone

- Condition: Price touches swing trendline or support level

- If confirmed: Trap recovery + MACD flow alignment → swing bounce likely

- Entry range: $228.00 ~ $231.30

- Expected box period: 5–9 sessions

- Reason: Trap resolution + MACD convergence

- Target tie-in: “Linked to 2-month target of $264.30”

✅ Mid-Term Entry Zone

- Condition: Touching mid-term trendline / support

- Entry range: $218.50 ~ $222.00

- Expected box period: 9–15 sessions

- Reason: Trap resolution + MACD convergence

- Target tie-in: “Linked to long-term target of $287.00”

7️⃣ Forecast

GE stock forecast / GE Aerospace price outlook

- Paris Air Show will determine momentum sustainability

- MACD is converging; RSI is neutral, leaving room for upside

- Breakout from triangle compression will be the key trigger for the next trend leg

8️⃣ Deep-Dive Section

- Institutional Flow: Accumulation by BlackRock and Vanguard

- Short Interest: Below 3%, minimal short risk

- Community Activity: Positive sentiment over 65% on Reddit and X

- AI Sentiment: Ongoing accumulation signal detected in recent algo flow

✅ Brand Notice

This report is powered by VPAR rhythm-based technical analysis.