#ArqitQuantum #ARQQ #NasdaqStocks #QuantumSecurity #StockForecast #SwingTrading #RHYTHMIXAnalysis #TopTraderGeneLog #TechnicalBreakout #MomentumStock #MACDSignal #VolatilityPlay #AIStockAnalysis

Intro

Hello, this is Top Trader GeneLog.

To help beginners, this report is followed by an audio podcast discussion.

You can check the full post version on our blog.

For better market timing, refer to the real-time index flow shared in our live broadcasts.

Subscribe or leave a comment if you want continuous analysis.

Need a faster report? Select the priority request option.

1️⃣ Summary

After rebounding from a short-term support cluster about a month ago,

ARQQ briefly broke below and tested the swing support line, triggering a second wave of upward momentum.

Currently, it’s testing the upper limit of the short-term resistance,

with price tension and volume spike suggesting a potential expansion zone initiation.

2️⃣ Investment Opinion

ARQQ 2-week price target: +14.8% → $43.60 (Probability: 70%)

ARQQ 2-month price target: +38.1% → $52.45 (Probability: 60%)

ARQQ long-term price target: +61.1% → $61.20 (Probability: 45%)

🟢 The current zone forms a setup of trap-break recovery + MACD flow reversal,

making this a high-probability continuation area for the existing bullish wave.

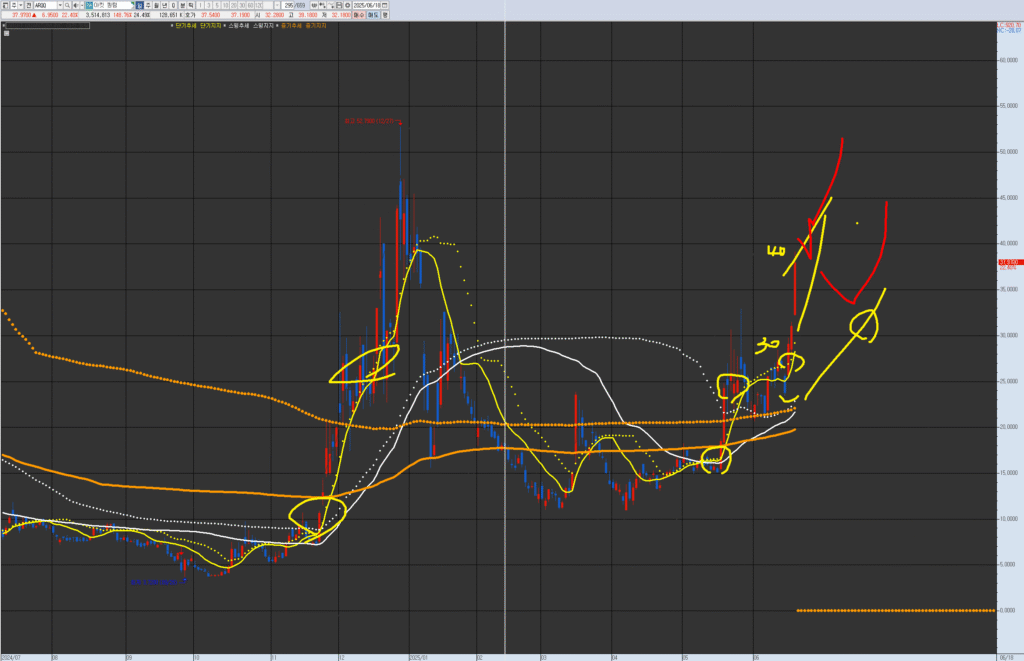

🔖 VPAR Chart Explanation

Here is the chart for Arqit Quantum (ARQQ) you requested.

Highlighted zones represent key technical convergence: short-term trend + support alignments.

These are near swing or mid-term support lines, increasing both probability and expected returns.

Each chart carries wave structures and tension zones—refer to the RHYTHMIX strategy sections for more insight.

3️⃣ RHYTHMIX Rhythm Analysis

- Price has rebounded from the swing support zone after a short-term breakdown.

- Currently testing the short-term resistance line, near the upper dotted limit

- Rhythm structure shows a shift from contraction to expansion.

- Short-term MACD flow: transitioning from convergence to upward trend.

- Swing MACD flow: maintaining upward momentum, with upper support forming

→ These dual confirmations indicate a strong entry into an expansion phase.

4️⃣ Financial Flow

Including the phrase: “ARQQ stock flow and financial status”

- FY25 H1 revenue: $0.067M (YoY ↓44%)

- Operating loss: $17.8M; Net loss: $17.2M

- Cash on hand: $24.8M, with ATM access up to $75M

- Active contracts: DoD, Tier‑1 telecoms (license-based revenue expected soon)

→ Financials are weak short-term but backed by sufficient liquidity and pipeline value.

5️⃣ News & Risks Summary

Including the phrase: “Key news affecting ARQQ stock”

- Jun 17: Joins Oracle Defense Ecosystem

- May 27: Acquired Ampliphae IP to strengthen encryption

- May 22: FY25 H1 earnings—Revenue delays, sustained losses

→ Sentiment is rising, but actual monetization still pending

6️⃣ Strategy Scenario

🎯 Entry Zones

Short-Term Buy Zone

- Setup: Return to short-term trend/support convergence

- Trap recovery + MACD convergence

- Entry range: $35.00 ~ $36.80

- Box range duration: 5–9 trading days

→ Target: “2-week target at $43.60”

Swing Buy Zone

- Setup: Retest of swing trend/support level

- Entry range: $30.50 ~ $33.00

- Box range duration: 6–12 trading days

→ Target: “2-month target at $52.45”

Mid-Term Buy Zone

- Setup: Mid-term rhythm base forming, post swing-line breakdown

- Entry range: $27.00 ~ $29.80

- Box range duration: 10–20 trading days

→ Target: “Long-term target at $61.20”

7️⃣ Forecast

Including the phrase: “ARQQ stock forecast”

Currently in an overbought state after recovery from a prior swing low.

With support flows confirmed and MACD angle steepening,

ARQQ may attempt a new yearly high, if consolidation near resistance remains tight.

8️⃣ Deep-Dive Analysis

- Institutional Flow: No major buys, but momentum pickup evident

- Short Interest: 7.8%, trending lower

- Community Buzz: Spike in mentions across Reddit & Stocktwits

- AI-based Flow: Algorithmic sentiment signals expansion entry

✅ Brand Notice

This report is based on the proprietary VPAR rhythm analysis methodology.