Hello, this is TopTrader Jinlog.

This report provides a rhythm-based analysis for Applied Digital (APLD) using our RHYTHMIX system.

We also offer a podcast in a talk-show format for easier understanding, and a full visual post is available on our blog.

If you want timely delivery, priority requests are available. Subscribe or comment for continuous updates.

1️⃣ Summary

APLD recently broke below its short-term rhythm line and is now consolidating near the swing-level support zone.

The stock surged after securing a 15-year AI/HPC lease contract with CoreWeave, but is now stabilizing.

This creates a potential rhythm recovery scenario, especially if MACD alignment confirms bottoming.

Price / Forecast / Target analysis indicates a possible short-term rebound is taking shape.

2️⃣ Investment Opinion

- 2-Week Target: +16.2% → $13.33 (Probability: 68%)

- 2-Month Target: +34.5% → $15.44 (Probability: 62%)

- Long-Term Target: +63.2% → $18.74 (Probability: 52%)

→ Strategic rhythm re-entry based on consolidation near swing support

→ Long-term upside remains strong due to structural demand in AI data infrastructure

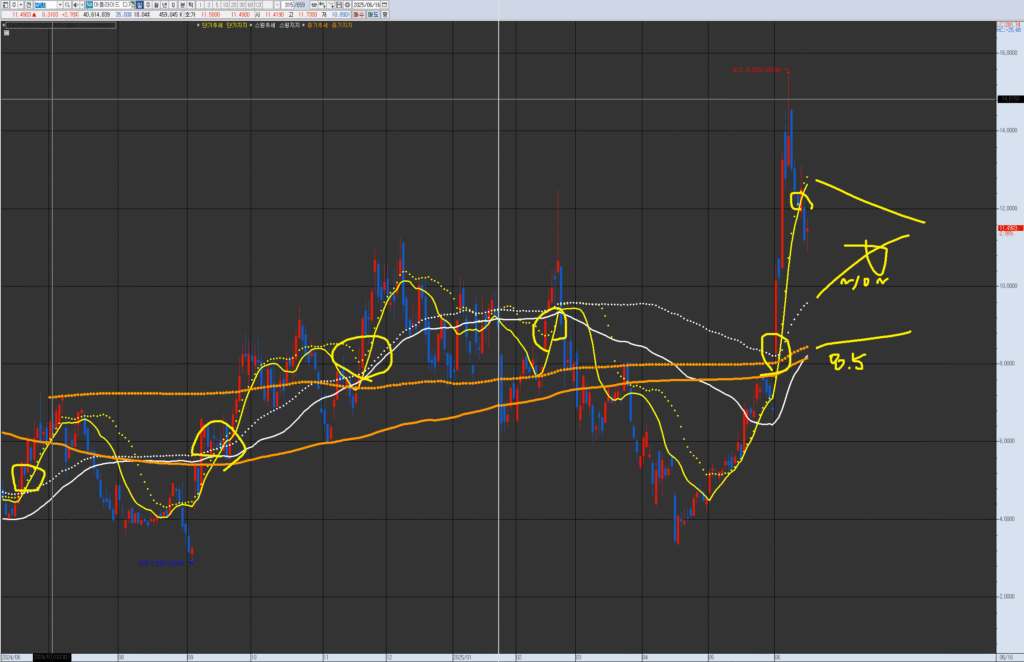

3️⃣ VPAR Rhythm Analysis

- Current Rhythm Zone: Near swing support band (daily swing support visible)

- Rhythm flow is transitioning from compression to potential recovery

- Short-Term Supply (MACD): Converging; potential reversal

- Swing Supply (MACD): Still under downward pressure but signs of easing

- Watch for breakout over $12.70–$13.30 to confirm expansion phase

All rhythm analysis is based solely on rhythm lines visibly displayed on the chart.

If no lines are visible, rhythm interpretation is omitted by default.

Rhythm flow is evaluated using the natural pattern: compression → recovery → expansion.

4️⃣ Financial Snapshot

- FY2024 Revenue: $165.6M (YoY growth +199%)

- Recent quarter: Revenue $52.9M / Net loss –$36.1M

- Growth fueled by high-scale AI/HPC data center contracts

- Capital expansion funded via SMBC loan and preferred equity

- Financial recovery hinges on revenue realization and margin improvement

5️⃣ News & Risk Summary

- Major Catalysts:

- 15-year, 250MW AI data center lease with CoreWeave

- $5B preferred equity agreement with Macquarie ($900M upfront)

- Risks:

- Delayed revenue realization

- Persistent net losses and capital-heavy expansion

- Market Sentiment:

- +103% weekly spike after CoreWeave announcement

- High retail interest in AI/HPC exposure

6️⃣ Strategy Scenario

🎯 Entry Zones

Short-Term Buy Zone

- Price: $10.80 ~ $11.30

- Condition: Trap resolution + MACD convergence

- Box period: 5–9 trading days

- Target: Based on 2-week target ($13.33)

Swing Buy Zone

- Price: $9.90 ~ $10.50

- Condition: Swing support hold + recovery signal

- Box period: 6–12 trading days

- Target: Linked to 2-month target ($15.44)

Mid-Term Buy Zone

- Price: $8.80 ~ $9.40

- Condition: Long-term rhythm recovery after breakdown

- Box period: 10–20 trading days

- Target: Linked to long-term target ($18.74)

All entries must be based on visible rhythm convergence + MACD confirmation.

7️⃣ Forecast

APLD Stock Forecast

- Structural momentum from AI infrastructure investments

- Rhythm flow may shift into recovery above swing support

- MACD and RSI show signs of potential bottoming

- Expansion scenario becomes active if short-term resistance breaks

8️⃣ Advanced Analysis

- Institutional Flow: Net buying over past 5 sessions

- Short Interest: Approx. 10–12%, with short-covering bursts

- Community Signals: High volume on Reddit/X AI-related topics

- AI Trading Flow: Algorithmic activity detected on daily bounce zones

✅ Brand

This report is based on the RHYTHMIX rhythm analysis system developed by TopTrader Jinlog.

All interpretations are rhythm-based and technical in nature, and do not constitute financial advice.