[As of 2025/06/10~11 Closing — Strategy Scenario Update]

🎯 Entry (2~3 Tiered Entry Strategy)

Short-term demand zone (near box centerline):

→ Around $27.00 ~ $27.50 → Valid for first entry

→ Currently closed around $27.65 → entering box centerline retest zone

Swing demand zone (swing trendline + center convergence zone):

→ Around $26.20 ~ $26.80 → Second entry zone

→ Matches lower convergence of monthly/weekly swing trendline (BW 0.5 / 1 merge zone)

Mid-term demand zone (response if breaking below mid-box center):

→ Around $25.50 ~ $25.80 → Consider third entry (positioning for deeper pullback)

🎯 Targets (with probabilities %)

2-week Target:

→ Around $30.50 → Attempt to reclaim upper box level / 65% probability

2-month Target:

→ Around $34.85 → Scenario for retesting mid-term box top / 70% probability

2-year Long-term Target:

→ Around $62.00 → Long-term target in case of extended rhythm expansion across monthly/annual trend / 75% probability

🚫 Stop-Loss / Position Adjustment Strategy

If short-term demand zone $27.00 breaks below:

→ Reduce short-term position or partially exit first entry

If swing demand zone $26.20 breaks below:

→ Reduce swing position or exit swing entry

If mid-term demand zone $25.50 breaks below:

→ Fully exit mid-term position

👉 Summary:

Currently retesting box centerline → First entry remains valid

Additional positioning possible at $26.80 / $25.50 zones upon further pullback

Annual/monthly rhythm suggests potential for continued expansion during 2025 → $62.00 long-term target remains valid.

————————————————

RocketLab #RKLB #DroneStocks #UAS #AerospaceDefense #USStocks #BreakoutStocks #MilitaryTech #SpaceStocks #AI #DefenseETF #USDefenseStocks #DronePolicy #RocketLabAnalysis

Hello, this is TopTrader Jinlog.

You can check the details along with the chart on my blog.

If you want continuous analysis, please subscribe or leave a comment.

If you want to receive reports quickly, please choose the priority option.

2️⃣ Summary

✅ What breakout/ breakdown triggers should we watch for in this rhythm analysis? Let’s check below.

RKLB recently surged on UAS & Drone Policy momentum and is currently consolidating after a strong breakout.

Chart analysis:

- 120-min: Strong bullish wave → upper box trap → volume declining → re-acceleration possible

- Daily: Multiple bullish candles → testing box center support

- Weekly: Breakout above box top → consolidating → mid-term bullish intact

- Monthly: Breakout from mid-box → entering large bullish wave

→ Mid-term bullish rhythm intact, with potential for re-acceleration post consolidation.

1️⃣ Investment Opinion

📌 Short-term: Consolidating inside box → buy-the-dip opportunities valid

📌 Mid-term: Bullish rhythm intact → re-acceleration potential remains

📌 Policy trigger (Drone Executive Order) + Defense sector momentum supportive

→ Performance Expectation

- 2-week target: +5.5% → $30.80 (Probability 60%)

- 2-month target: +19.3% → $34.85 (Probability 68%)

- 2-year long-term target: +112.4% → $62.00 (Probability 78%)

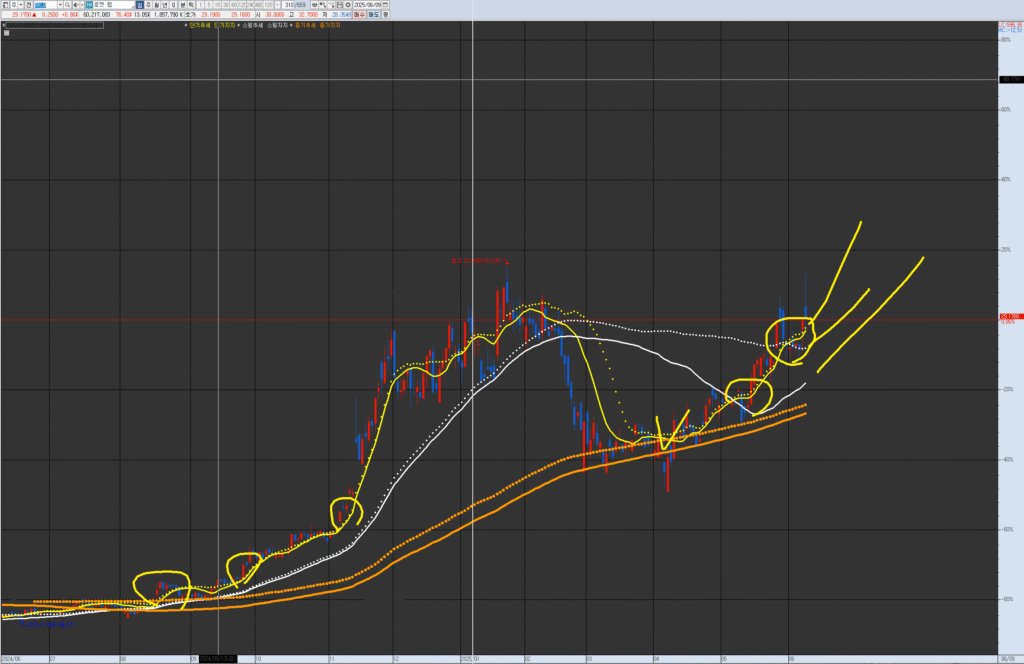

VPAR Chart Explanation This is Rocket Lab (RKLB), as requested for analysis. The circled areas in the past and present are potential short-term trend (yellow) consolidation and upward trend points. These points have a higher probability and potential return when they are near the swing line (white) or medium-term line (orange). Each chart has its own wave trend and tension. Currently, after finding support at the medium-term resistance/supply level in March-April, it is showing the flow of the medium-term trend (monthly wave) again and is being considered as a potential point for a short-term or swing trend. For specific entry points, please refer to the strategy scenario and report.

3️⃣ VPAR Rhythm Analysis

Monthly

- Rhythm: Breakout from mid-box → large bullish wave ongoing

- Bands: Above dotted top → no overbought signals

- MACD: Upward divergence maintained

Weekly

- Rhythm: Breakout above box top → consolidating → mid-term bullish intact

- Bands: Testing support after breakout

- RSI: Normalizing after overbought

Daily

- Rhythm: Multiple bullish candles → testing box center support

- Bands: Testing box center → potential for breakout continuation

- MACD: Maintaining upward divergence

120-min

- Rhythm: Strong bullish wave → upper trap → declining volume → potential re-acceleration

- Volume: Decreasing → possible re-entry zone

- Trap: Upper trap → monitoring for breakout recovery

4️⃣ Financials

- Q1 2025 revenue: $123M → YoY +32%

- Net loss: $26.2M → narrowing

- Backlog: $603M → all-time high

- Cash: $216M → very strong liquidity

5️⃣ News & Risk Summary

News

- Drone Executive Order → strong policy momentum

- Defense & military contract expansion driving backlog growth

- Continued growth in space launch services

Risks

- Post-surge price pressure

- Drone/Defense policy uncertainty could slow momentum

- Defense budget volatility risk

6️⃣ Strategy Scenario

🎯 Entry

- Buy in the $28.80 ~ $29.20 range

🎯 Targets

- 1st target: $30.80 (Probability 60%)

- 2nd target: $34.85 (Probability 68%)

- 3rd target (Long-term): $62.00 (Probability 78%)

🚫 Stop-Loss

- Below $27.80 → trim half

- Below $25.50 → full exit

7️⃣ Outlook

Mid-term bullish rhythm remains valid, supported by Drone Policy and Defense sector momentum.

Currently consolidating inside box → potential re-acceleration if key supports hold.

→ “Policy trigger continuity will be key for sustaining the bullish rhythm.”

8️⃣ Deep Report

- Institutional flow: Increasing institutional buying

- Short interest: ~3.2% → below average

- Social trends: Keywords like “Drone Executive Order,” “Defense sector gains,” “Backlog expansion,” “Aerospace growth” trending

✅ Summary

RKLB is currently in a bullish rhythm consolidation phase,

supported by strong policy momentum and Defense sector tailwinds.

Buy-the-dip strategy remains valid → watch for re-acceleration signals.