BitcoinDepot #BTM #BitcoinATM #RhythmReport #TopTraderJinlog #CryptoStocks #BitcoinStocks #RhythmAnalysis #USStocks #BreakoutStocks #Blockchain #ETF #HighVolatilityStocks #BTCLinkedStocks

Hello, this is TopTrader Jinlog.

You can check the details along with the chart on my blog.

If you want continuous analysis, please subscribe or leave a comment.

If you want to receive reports quickly, please choose the priority option.

2️⃣ Summary

✅ Is there still a short-term breakout potential in the current rhythm? Let’s analyze now.

BTM recently surged +23% on new CFO appointment and earnings optimism, breaking its recent highs.

Chart analysis:

- 120-min: Large bullish candle → upper trap → volume declining → consolidation likely

- Daily: Multiple bullish candles → upper box breakout → overbought signal

- Weekly: Breakout above box top → maintaining bullish structure

- Monthly: Large bullish candle → strengthening mid-term bullish rhythm

→ A classic post-breakout box consolidation phase, with potential for another bullish leg if key support holds.

1️⃣ Investment Opinion

📌 Short-term: Overbought → likely entering box consolidation → buy-the-dip opportunities

📌 Mid-term: Bullish rhythm intact → potential for re-acceleration

📌 BTC price correlation↑ / sector-wide fundamentals improving

→ Performance Expectation

- 2-week target: +6.2% → $6.60 (Probability 55%)

- 2-month target: +24.9% → $7.77 (Probability 65%)

- 2-year long-term target: +142.2% → $15.07 (Probability 75%)

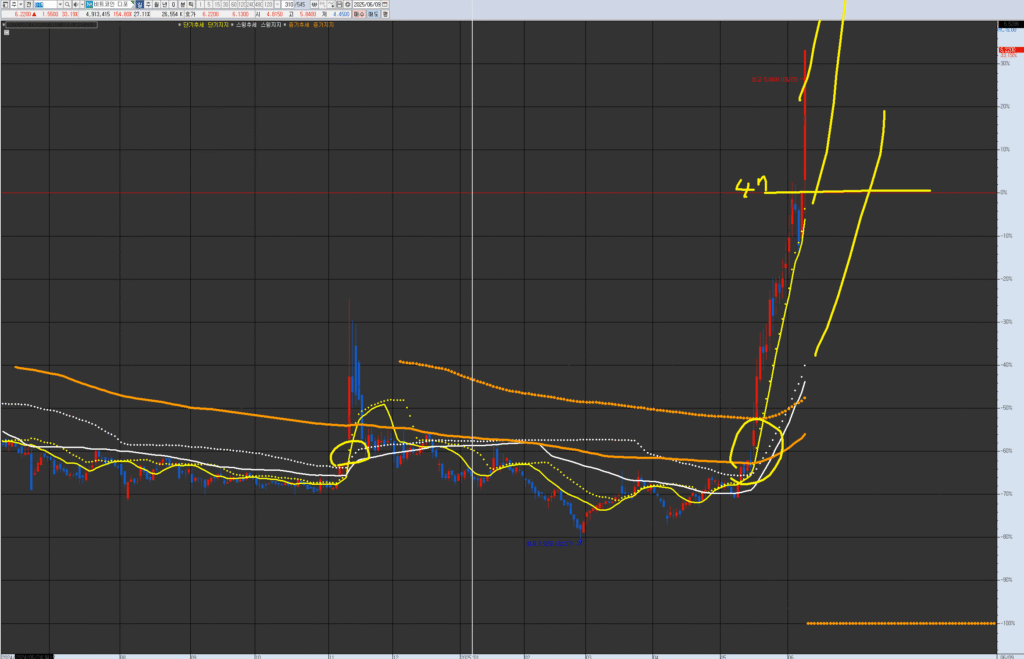

VPAR Chart Explanation This is Bitcoin Depot (BTM.NAS), as requested for analysis. The circled areas in the past and present are potential short-term trend (yellow) consolidation and upward trend points. These points have a higher probability and potential return when they are near the swing line (white) or medium-term line (orange). Each chart has its own wave trend and tension. Currently, after breaking through the medium-term resistance/supply in mid-May, it is continuing the short-term trend (daily wave) and is in a state of a 33% sharp upward move (“shooting”), although the minute chart shows divergence. If 6 dollars holds as support, there is a possibility of continuing the upward trend. Even if it breaks below (6 dollars), as long as Bitcoin’s swing trend is not broken, consider entering on dips to the short-term or swing line. For specific entry points, please refer to the strategy scenario and report.

3️⃣ VPAR Rhythm Analysis

Monthly

- Rhythm: Large bullish breakout → mid-term bullish rhythm strengthening

- Bands: Broke upper box → overbought signal

- MACD: Strong bullish crossover

Weekly

- Rhythm: Breakout above box top → consolidation likely

- Bands: Above dotted top → testing center support

- RSI: Overbought → potential short-term pullback

Daily

- Rhythm: Multiple bullish candles → upper trap → possible consolidation

- Bands: Above box top → monitoring for mean reversion

- MACD: Forming bullish divergence

120-min

- Rhythm: Large bullish candle → upper trap → volume declining → box consolidation likely

- Volume: Decreasing after spike → watch for re-acceleration signals

- Trap: Upper trap → recovery attempts to be monitored

4️⃣ Financials

- TTM revenue: ~$699M → YoY +13.4%

- Net loss: ~$14.6M → losses continuing

- Aggressive expansion strategy in Bitcoin ATM market → leadership intact

- Cash: $8.5M → sufficient for next 12 months

5️⃣ News & Risk Summary

News

- New CFO appointed (ex-American Express) → increased confidence

- Expanded strategic partnership with NCR → new growth potential

- Institutional buying increasing → confirmed through recent flows

Risks

- Overbought post-surge

- Competitive pressure in ATM market

- High BTC price correlation → volatility risk

6️⃣ Strategy Scenario

🎯 Entry

- Buy in the $6.00 ~ $6.22 range

🎯 Targets

- 1st target: $6.60 (Probability 55%)

- 2nd target: $7.77 (Probability 65%)

- 3rd target (Long-term): $15.07 (Probability 75%)

🚫 Stop-Loss

- Below $5.75 → trim half

- Below $5.20 → full exit

7️⃣ Outlook

Currently entering a post-breakout consolidation phase.

Mid-term bullish momentum remains valid, with BTC price and sector news likely to act as key triggers.

→ “Monitoring box support → buy-the-dip strategy is valid in this rhythm.”

8️⃣ Deep Report

- Institutional flow: Net buying by institutions increasing

- Short interest: ~2.6% → below average for crypto stocks

- Social trends: Keywords like “New CFO,” “Bitcoin ATM growth,” “BTC rally-linked stocks” trending

✅ Summary

BTM remains in a high-volatility rhythm consolidation phase,

with valid mid-term breakout potential aligned with BTC market movements.

Buy-the-dip strategy → re-acceleration watch is valid.